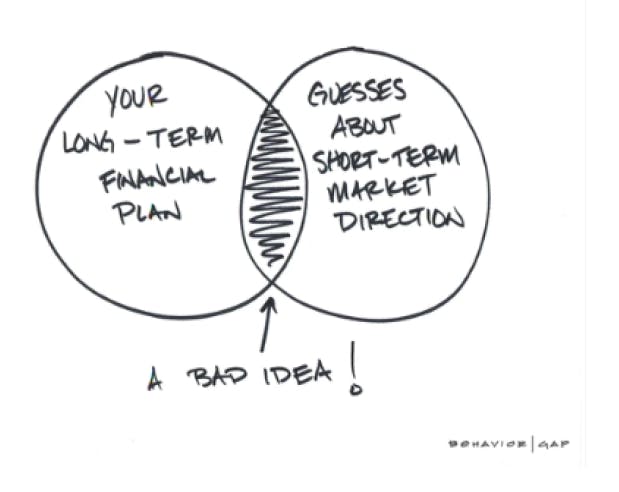

Should I get out of the market until…

Each and every month we get a question that is similar to the statement above. The questions are sincere but based on the assumption that one can invest in the markets painlessly. What I mean by that is I can get marketlike returns when the market is going up, then jump out of the market...