Category: Financial Anxiety

As a seasoned financial planner with over three decades of experience in the industry, I've witnessed countless instances where investing common sense has clashed with our natural instincts. It's a fascinating paradox...

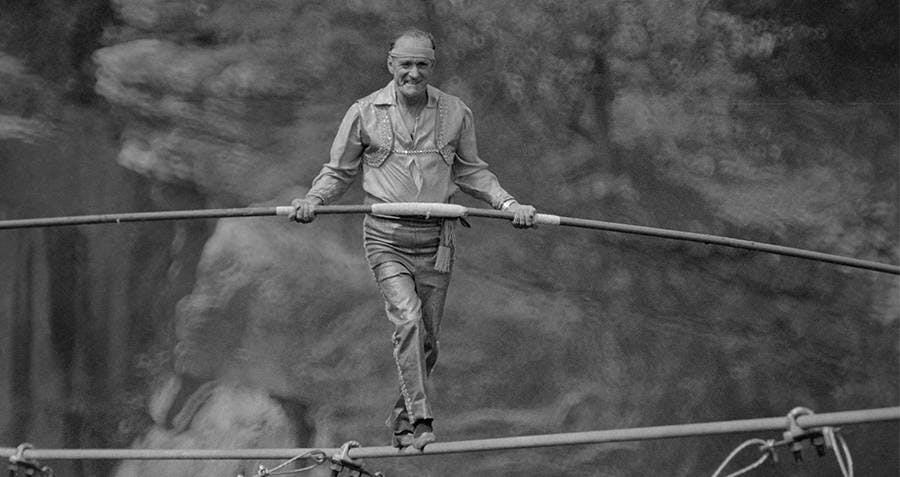

Let me start by stating one can gain investment know how (knowledge) by reading books listening to podcasts, and studying investment materials. In the same way one can learn to walk a tightrope by practicing in the backyard on a rope 6 inches off the ground. You can become very good at navigating that tightrope in the backyard. When the tightrope is strung between two buildings 300 foot off the ground that "experience" isn't as valuable.

Welcome to the complex yet fascinating world of investing. Like you, I am an investor and over the past five decades, I've had the privilege of witnessing the intricacies of financial markets, making my fair share of mistakes, and, most importantly, learning from them. As you embark on your investing journey, I'm here to share with you the ABCs of investing, with a touch of wisdom gained through experience.

What is in a simple Estate Plan? If you’re like most people, with a few kids and a house, you only need a will. You can use an online service like www.freewill.com or www.mamabearlegalforms.com. The most common option is to meet with a local lawyer to help you discuss and setup the three documents needed...

Let’s tackle a topic that has been on many investors’ minds in the last few years, and has prompted more than just a few blog postings. Being worried during market downturns is understandable and NORMAL; but I want to emphasize the importance of viewing investing as a long-term endeavor, and how to avoid (and why...

Estate planning is just a fancy legal-ish word for what you want to happen to your money and stuff when you die or become disabled.

What is American Exceptionalism? There is no other country in the world that represents the blend of classical philosophy, Christianity, and even Enlightenment ideas in the way America did in the founding of the republic from 1776 to 1789. It was an exceptional (meaning uncommon) mixture of liberty, limited government, natural rights, and religious liberty...

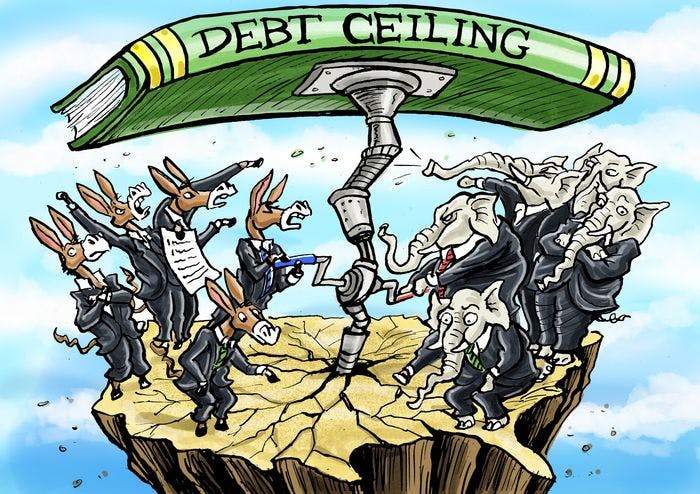

Every few years we have this discussion about whether or not we are going to raise the debt ceiling. Let’s just be honest, the debt ceiling will be raised. Since 1960, it’s been raised 78 times (more than once a year). The chart below shows the times the debt ceiling has been raised since 1970....

As a financial planner, I know that Social Security benefits are (or will be) a critical source of retirement income for many of our clients (and most Americans), particularly those who are 55 or older. According to the Social Security Administration (SSA), in 2021, the average monthly Social Security retirement benefit for a retired worker is $1,557. Over the next 3 weeks I will cover strategies you can take to maximize your potential Social Security benefit.

As a financial planner with 25 years of experience, I understand that investing can be daunting, especially in uncertain times. With recent news of bank financial distress, it's natural for many clients to feel anxious about the safety of their investments. However, I'm here to assure you that the US economy, markets, and financial system are resilient, and there's no need to panic.