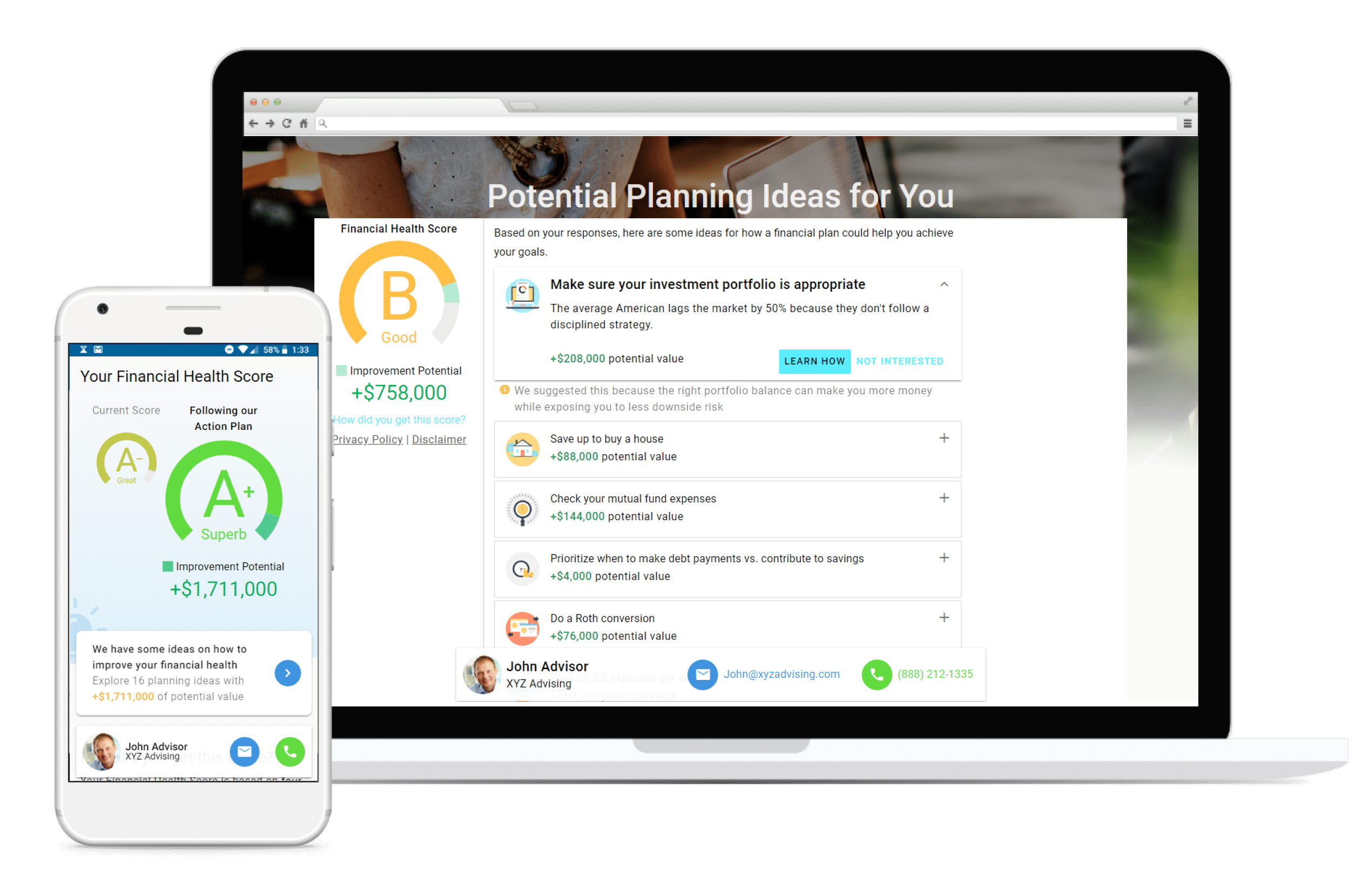

Your Future Deserves a Plan.

Because your goals are too important to leave to chance.

You wouldn't go on vacation without first planning the trip. You know where you're going, where you'll stay, and what you'll see and do before ever leaving home.

Many hours go into deciding how to spend a few weeks each year, yet we often treat our entire financial future as if everything will somehow work out. This optimism and blind hope falls apart when you think about exactly how you will…

- Retire with confidence

- Help a child through college

- Support your aging parents

- Get rid of burdensome debt

…Or achieve any other significant financial goal.

At Masters Financial Group, we believe you should be able to enjoy today while having peace and confidence about your future.