Category: Financial Advice

This is a summary of the article “3 Mistakes to Avoid When Preparing for the 2024 Election” by Samantha Lamas. During election years, individuals are particularly susceptible to cognitive biases, driven by the high stakes involved in potential outcomes. Uncertainty dominates, overwhelming rational thought processes. As the 2024 election approaches, it’s crucial to recognize and...

Have you ever bought a stock “just because everyone else was”? Felt pressured to invest in a trendy new technology, even if you didn’t fully understand it? Welcome to the wild world of herd behavior in behavioral finance! Simply put, herd behavior is our tendency to mimic the actions of others, especially when faced with...

As a seasoned financial planner with over three decades of experience in the industry, I've witnessed countless instances where investing common sense has clashed with our natural instincts. It's a fascinating paradox...

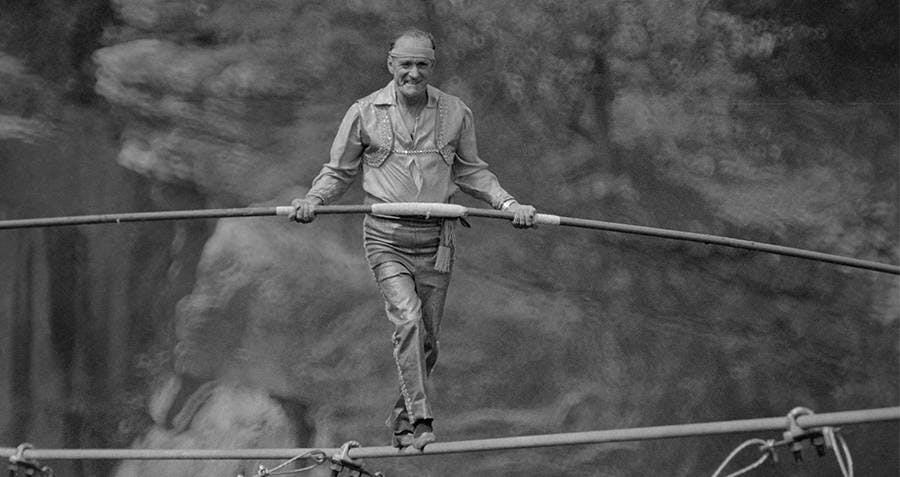

Let me start by stating one can gain investment know how (knowledge) by reading books listening to podcasts, and studying investment materials. In the same way one can learn to walk a tightrope by practicing in the backyard on a rope 6 inches off the ground. You can become very good at navigating that tightrope in the backyard. When the tightrope is strung between two buildings 300 foot off the ground that "experience" isn't as valuable.

Welcome to the complex yet fascinating world of investing. Like you, I am an investor and over the past five decades, I've had the privilege of witnessing the intricacies of financial markets, making my fair share of mistakes, and, most importantly, learning from them. As you embark on your investing journey, I'm here to share with you the ABCs of investing, with a touch of wisdom gained through experience.

What is in a simple Estate Plan? If you’re like most people, with a few kids and a house, you only need a will. You can use an online service like www.freewill.com or www.mamabearlegalforms.com. The most common option is to meet with a local lawyer to help you discuss and setup the three documents needed...

Let’s tackle a topic that has been on many investors’ minds in the last few years, and has prompted more than just a few blog postings. Being worried during market downturns is understandable and NORMAL; but I want to emphasize the importance of viewing investing as a long-term endeavor, and how to avoid (and why...

Estate planning is just a fancy legal-ish word for what you want to happen to your money and stuff when you die or become disabled.

We’ve blogged about responsible credit card usage, calculations used to determine minimum payments, and other points on credit cards. This week we’ll discuss some common “tips” you may receive from friends and family about credit cards. Myth #1 Paying the minimum balance is ok Sure, paying the minimum due is acceptable and it’s actually welcomed...

Do you know what percentage of income your mortgage payment is? Your car loan? Do you set debt targets? Debt targets are not a new concept, however, in my opinion, they are not discussed nearly enough with individuals of all stages of life. When you bought your first house did you aim for your mortgage...