Real long term financial risk is not loss of principal but erosion of purchasing power.

- To maintain the purchasing power of $100 from 1926 to 2022 you would need $1,674.

- $100 invested in the S&P 500 in 1926 would be worth $1,066,955 in 2022.

These example above illustrates the REALLY long term erosion of purchasing power. Since none of us were around in 1926, what about since 1996 (about 25 years)?

- To maintain the purchasing power of $100 from 1996 to 2022 you would need $189.

- $100 invested in the S&P 500 in 1996 would be worth $1,008 in 2022.

Before we discuss how to protect your purchasing power let’s define what LONG term means. For our purposes it is at least five years or more. If you have a goal that will require you to liquidate your investment in five years or less, you should put your money in a savings, CD or money market account.

Investing with the goal of growing your wealth (at the very least) in a manner that will protect your moneys purchasing requires a commitment of 5+ years. Why? Because investment that have a chance to earn a rate of return greater than the rate of inflation will have some level of uncertainty / volatility (when an investment experiences periods of unpredictable price movements). In plain English it means that to preserve my purchasing power I must invest in investments that have some uncertainty as to what they will be worth 5+ years in the future. The greater the volatility, the broader the range of likely outcomes.

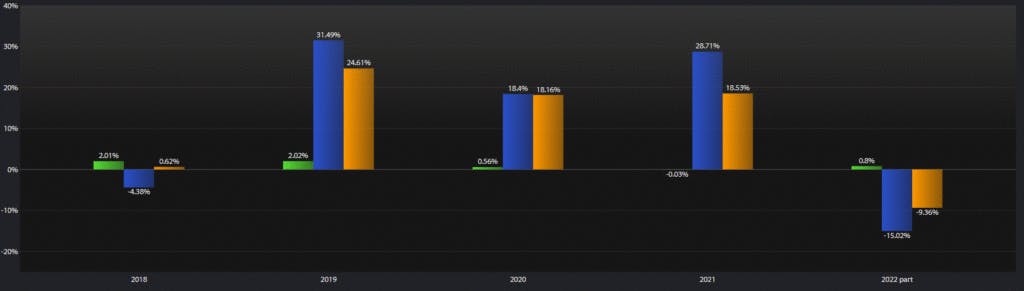

Below are 3 different investments with different levels of volatility:

Investment A (0.3%) Investment B (19.4%) Investment C (14.2%)

Investment A’s range of returns over the past 5 years -.03% to 2.02% (little volatility / predictable) The average return over the past 5 years was 1.13% per year. (did not preserve purchasing power)

Investment B’s range of returns over the past 5 years -15.02 to 31.49% (very volatile / unpredictable) The average return over the past 5 years was 12.17% per year (did preserve purchasing power)

Investment C’s range of returns over the past 5 years -9.36% to 24.61% (less volatile / unpredictable) The average return over the past 5 years was 10.52% per year (did preserve purchasing power)

Investment B and C involve investments in a basket of equities or stocks. Stocks for our discussions mean the entire asset class (like the S&P 500) or a diversified mutual fund portfolio, not a handful of individual stocks.

Historically the longer the investment period, the greater the likelihood that stocks will produce positive returns. There have been 5 year periods in which investing in stocks would have returned less than you invested. This is why it is important to have funds that are need in the next 5 years in investments with little or no volatility.

On the other hand to avoid investing in stocks because they are volatile is to surrender to the gradual loss of purchasing power of your long term investments (like retirement accounts). Should a retiree have as much money invested in stocks as a 35 year old? Probably not. Should a retiree have some of their retirement savings invested in stocks? Yes.

How much should you have invested in stocks to protect your purchasing power? That is a question best answered by meeting with a trusted financial planner who has an understanding of your individual situation and can help you make that decision.

If you do not have a trusted advisor you can click here to schedule a time to talk to someone at our office.

Dave Conley, CFP