Each and every month we get a question that is similar to the statement above. The questions are sincere but based on the assumption that one can invest in the markets painlessly. What I mean by that is I can get marketlike returns when the market is going up, then jump out of the market when things are going down until…

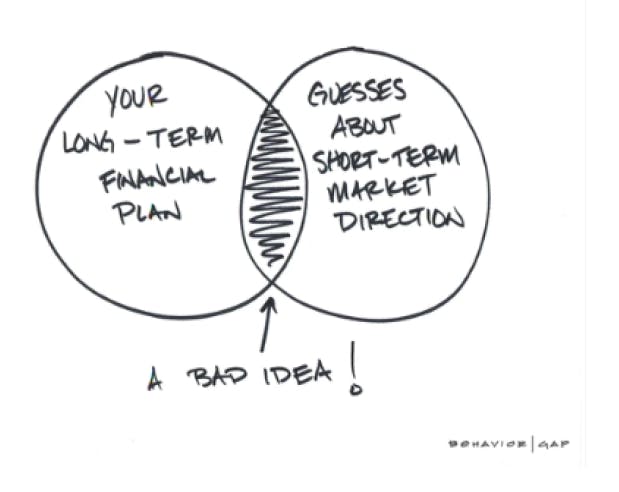

This is what we call market timing. Market timing describes the strategy of trying to time one’s trades (in and out of the market) based on predictions (feelings) about future market movement. Psychology and emotions play a huge role here. Investors may feel that their investments are “due for a correction” after flying high, or that they’re due for a comeback after a recent drop, but nothing says the investment can’t continue going up or down respectively. The primary reason this strategy does not work is that the stock market’s gains for any given year come from just a handful of days of stellar performance. Thus the key to having a successful investment plan is to have a well thought out investment plan that accounts for both up and down markets and stick with the plan.

Here are my 5 steps to stay invested when the markets are not moving the way we want (up):

- Have an emergency fund that is equal to at least 6 months expenses. (If retired 12 months).

- Have a balanced investment plan that has you diversified among various asset classes.

- Understand your investment horizon.

- A 60 year old retiring in 5 years does not have a 5 year investment horizon. They have a 20-25 year investment horizon as they will likely live to the age of 80-85.

- Work with an investment advisor who can talk you off the ledge and point you back to your investment plan. It is OK to be fearful but do not be controlled by your emotions, talk with someone who can look at the facts and provide wise counsel.

- Live your life. If you have a trusted advisor who you have entrusted to manage your investments then let them do the job you pay them to do. You should focus on the people that you love rather than fearing you will run out of money.

Dave Conley, CFP