What will happen in the economy in 2023? Recession? Soft landing? Higher interest rates or lower rates? High inflation, lower inflation or stagflation? If all the economic “predictors” were laid end to end, they’d never reach a conclusion.

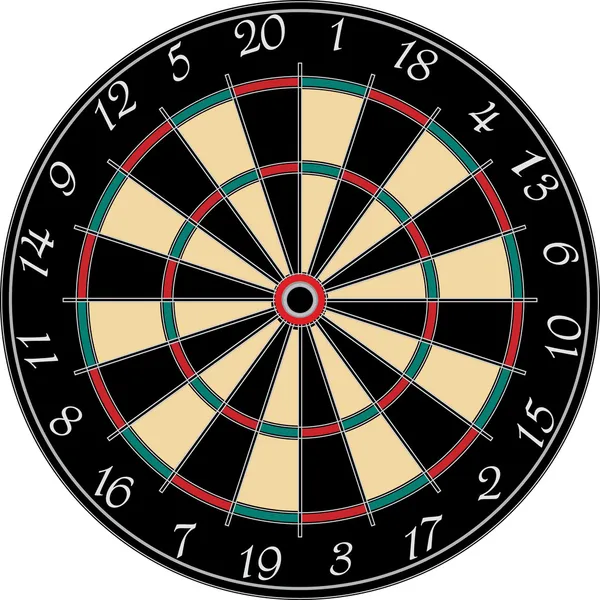

Predicting the direction of the market is like predicting when you will hit the bulls-eye in a dart game. The majority of the time throughout market history, the markets have been rising. History shows that the chance of your money growing in a diversified portfolio of stocks and bonds is much like the odds of your next dart hitting any number on the dartboard… except the bulls-eye. If you are going to try and time the market by moving your money in and out, you have to ask yourself how confident are you that you can hit the bullseye when you do.

So let’s explore the range of possible scenarios and the odds of each representing the future based on the facts we have available at this time.

Three possible economic forecasts and how that will effect the stock market in 2023 are shown in the graphic below. As of this morning (01/04/2023) the S&P was about 3,858. The 3 different forecast scenarios below reflect where it may be at the end of 2023 and economic conditions that drive those forecasts. The forecasted market returns range between -5% to +33% all determined by:

- Economy – Recession, flat or soft landing.

- Inflation – Stays high, gradually falls, falls faster than expected.

- Interest Rates – Stays high or increases, moves lower slowly, moves lower substantially.

- Federal Reserve – continues to tighten through 2023, pauses or projects stable or falling rates.

- Geopolitical – China and COVID, Russia and Ukraine. something not on the radar.

Measure your progress with an odometer not a ruler

Measuring your investment results based the past 12-18 months is like planning a long trip (say to Myrtle Beach) and measuring the distance with a ruler rather than your cars odometer. Using a 12 inch ruler to measure a long journey (in feet) rather than miles is what people do when they watch CNBC, read the gloom and doom click bait online, or make decisions about their long term investing journey based on the markets performance in 2022. They are measuring their investing journey (which lasts until death) with the equivalent of a ruler.

Since when is it helpful spending our time focusing on things we cannot control? We know that regardless of what the market does in 2023, the market (U.S. Economy) is larger than it was 10 years ago. It is very likely that the economy (and the market) will be bigger or higher 5 – 10 years from now. Stay focused on your long term goals, understand that markets have risen risen and declined since their inception. The S&P 500 was 435 in 1992, 879 in 2002, 1,426 in 2012, and ended 2022 at 3,839… what you see is a long term trend of the U.S economy growing consistently over time. It does not go up every year but focus on the direction of the market over time.

If you have any questions or concerns about your investments feel free to reach out by phone (864) 862-9269 or email [email protected].

Dave Conley, CFP