Navigating Investment Challenges: Insights from Three Decades of Financial Planning

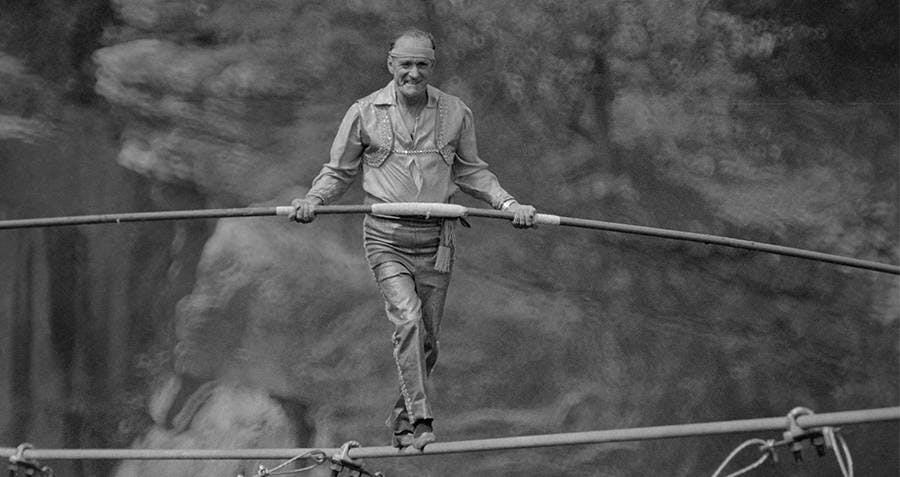

Let me start by stating one can gain investment know how (knowledge) by reading books listening to podcasts, and studying investment materials. In the same way one can learn to walk a tightrope by practicing in the backyard on a rope 6 inches off the ground. You can become very good at navigating that tightrope in the backyard. When the tightrope is strung between two buildings 300 foot off the ground that "experience" isn't as valuable.