The “secret” to investing success is spelled TIME

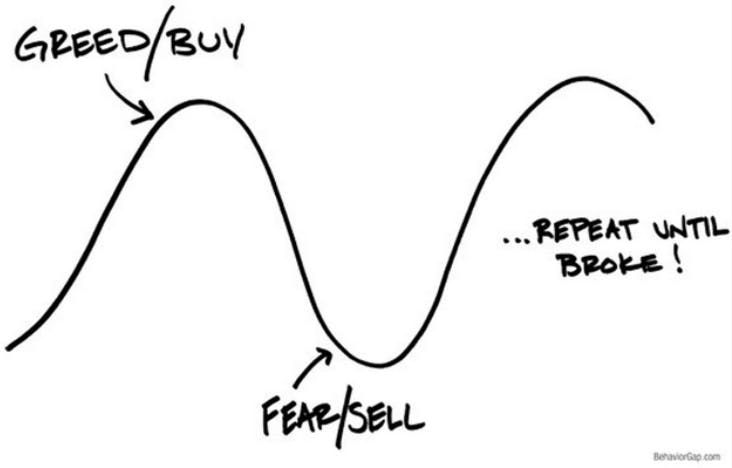

The hamster wheel literally describes the concept of lots of activity but making no progress. In times of crisis, either real or imagined we are encouraged to do something. If your house is on fire or if you witness a car accident you must do something and quick. Why is it that doing nothing when it comes to our investments is so difficult. When clients ask "what are you doing..." sometimes the better question is "is there anything that needs to be done" related to our investments? Are you OK with doing nothing when nothing needed to be done?