When conversations navigate toward the topic of retirement, one of the most common subjects discussed is IRAs.

If you are unaware, IRA stands for individual retirement account, meaning it is not offered through your employer, you made a choice to start saving into a retirement account on your own.

Traditional IRAs are invested pre-tax, and Roth IRA contributions are post-tax. You can contribute to these IRAs if you have earned income

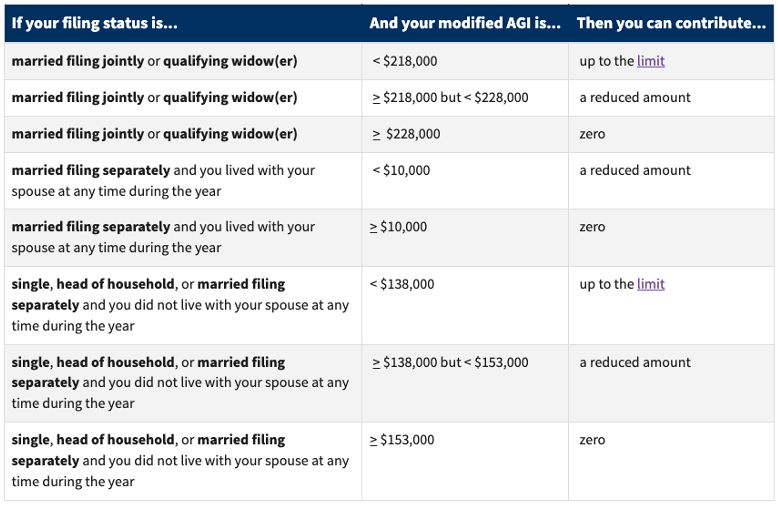

Can anyone contribute to a Roth IRA?

- If an individual or household makes more than the limits set by the IRS, they are unable to contribute to a Roth IRA, or they can contribute a reduced amount (see chart below from IRS.gov).

IRS

Do you know how much you can contribute annually to a Roth or Traditional IRA?

- Eligible individuals can contribute $6,000 a year into their IRAs (total).

- Meaning, if you wanted to max out a Roth and Traditional IRA, you cannot in the same year. The contributions are set to $6,000 for all IRAs.

Or that the contribution limits are being raised in 2023?

- IRA contribution limits are increasing to $6,500 annually in 2023.

Do you know about catch-up contributions?

- Catch-up contributions are for investors over the age of 50, those limits are $1,000 more than those under the age of 50 ($7,000 in 2022, and $7,500 in 2023).

What about spouses that do not work outside the home?

- A spousal IRA allows a working individual, who earns income, to fund a retirement account in their spouse’s name. This is an exception to the rule you must have earned income to contribute.

- These are not joint accounts; they are specifically for the individual who does not have earned income.

- The annual contribution limits are the same, and a spousal contribution does not count toward the working individual’s IRA contribution limits.

Do you know which IRA is best for you? Do you have any other questions about individual retirement accounts? Reach out, we’ll guide you in the right direction!