I’ve been asked many times “if Dave Ramsey says to fund a Roth IRA, why would I ever choose a traditional IRA”?

Well, much like any advice, there is no absolute in reference to what will work best for everyone in every situation. Let’s examine the main characteristics of both types of IRAs.

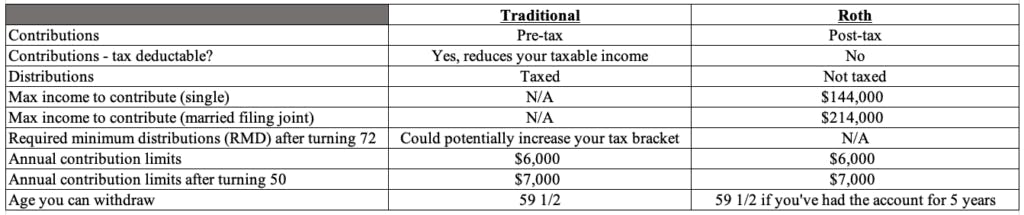

As you can see, the main difference is how they are taxed.

When would it be good to choose a Traditional IRA?

When an individual expects to be in a lower tax bracket in retirement.

- If you are in the 24% tax bracket currently and expect to be in the 12% tax bracket in retirement, it would not make sense to fund a Roth IRA

- Why? You would be paying 24% in taxes before contributing.

- You would want to fund a Traditional IRA (pre-tax contributions), to save an estimated 12% in taxes when you begin withdrawals.

When would it be good to choose a Roth IRA?

When an individual expects to be in a higher tax bracket in retirement.

- If you are in the 12% tax bracket and expect to be in the 24% tax bracket later in your career, and in retirement, a Traditional IRA would not make sense for you.

- Why? You would pay 12% now, instead of paying 24% when you begin withdrawing from your IRA.

- Typically, younger investors find themselves in this situation as they begin their careers.

See IRA calculators below for visual references, the Roth vs. Traditional IRA calculator can be found here.

Are you still confused, or maybe confused even more now? Contact us here so we can help!