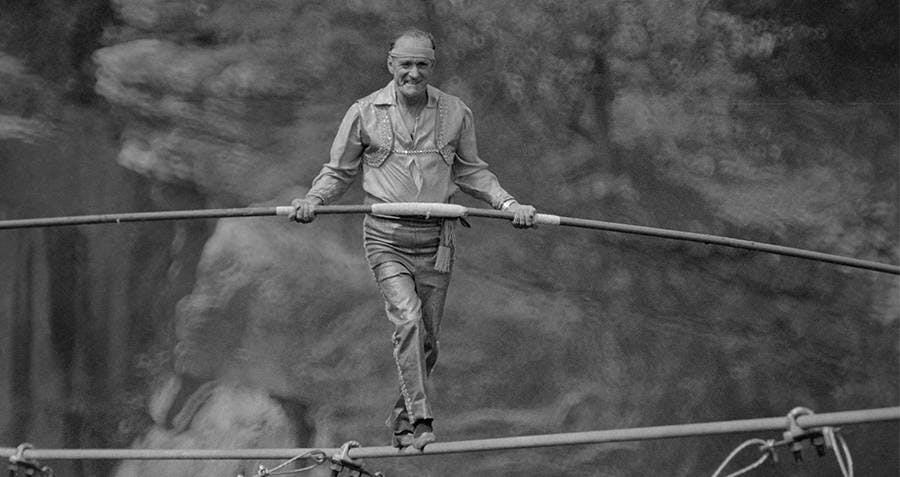

Let me start by stating one can gain investment know how (knowledge) by reading books listening to podcasts, and studying investment materials. In the same way one can learn to walk a tightrope by practicing in the backyard on a rope 6 inches off the ground. You can become very good at navigating that tightrope in the backyard. When the tightrope is strung between two buildings 300 foot off the ground that “experience” isn’t as valuable. Why? There is no risk when the rope was in the backyard. It is the same with investing. Just because you know what to do, when the money invested is your retirement funds (aka life savings) do you want to go it alone?

With over three decades of experience navigating the complexities of the financial markets, I’ve witnessed firsthand the ebbs and flows of economic cycles, political upheavals, and global crises. In this ever-changing landscape, the importance of having an experienced partner by your side cannot be overstated. Here’s are my reflections on the significance of partnering with a seasoned financial planner to enhance your chances of investing successfully:

Weathering Market Volatility

Throughout my career, I’ve guided investors through numerous boom and bust cycles, from the euphoria of market rallies to the despair of steep downturns. While market cycles (and volatility) are inevitable, having a seasoned financial planner working with you can provide invaluable perspective and discipline. By implementing sound investment strategies tailored to your financial goals and risk tolerance, we can navigate through turbulent times with confidence and resilience.

Navigating Political Uncertainty

Elections, wars, and geopolitical tensions can have an impact on financial markets (though typically short-term), often leading to heightened uncertainty and market fluctuations. Having an experienced partner who understands the interplay between political events and market dynamics can help investors make better decisions amidst uncertainty.

Mitigating Economic Risks

From recessions to inflationary cycles, economic challenges can pose significant risks to investors’ portfolios. Drawing on decades of experience, I work closely with clients to develop comprehensive financial plans that account for various economic scenarios. Whether it’s implementing defensive strategies during economic downturns or capitalizing on growth opportunities during periods of expansion, having a seasoned financial planner can help safeguard your financial future against economic headwinds.

The Value of Experience

In today’s complex financial landscape, the value of experience cannot be overstated. By partnering with a financial planner who has weathered multiple market cycles and navigated through myriad economic challenges, investors can benefit from seasoned insights, disciplined strategies, and personalized guidance tailored to their unique circumstances. Whether you’re planning for retirement, saving for a child’s education, or building wealth for the future, having an experienced partner working alongside you can significantly improve your chances of investing successfully.

Very frankly feeling scared is normal. The last thing you need is a lecture on the history of long-term stock market returns. You don’t need facts and figures; you need a hug, someone to listen, a little bit of empathy. After the hugging is over and everyone is feeling reasonable again, we can review the careful analytical work that went into designing your portfolio. We can revisit the goals and values we factored into that analysis. We can even consider the weighty evidence of history and talk about how the best thing we can do is stay invested.

In conclusion, partnering with an experienced financial planner is essential for navigating the myriad challenges and opportunities presented by the financial markets. With a seasoned partner by your side, you can navigate market volatility, political uncertainty, and economic risks with confidence, knowing that your financial future is in capable hands.

Dave Conley, CFP

Your ultimate investing success or failure will depend on your ability to ignore the worries of the world long enough to allow your investments to succeed.

– Peter Lynch, Former PM of the Fidelity Magellan Fund