Tag: Masters Financial Group

This is a summary of the article “3 Mistakes to Avoid When Preparing for the 2024 Election” by Samantha Lamas. During election years, individuals are particularly susceptible to cognitive biases, driven by the high stakes involved in potential outcomes. Uncertainty dominates, overwhelming rational thought processes. As the 2024 election approaches, it’s crucial to recognize and...

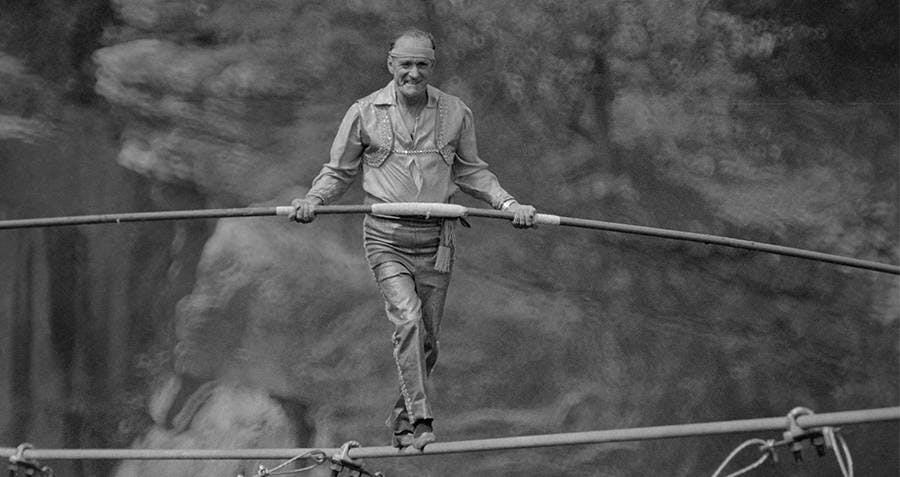

Let me start by stating one can gain investment know how (knowledge) by reading books listening to podcasts, and studying investment materials. In the same way one can learn to walk a tightrope by practicing in the backyard on a rope 6 inches off the ground. You can become very good at navigating that tightrope in the backyard. When the tightrope is strung between two buildings 300 foot off the ground that "experience" isn't as valuable.

Welcome to the complex yet fascinating world of investing. Like you, I am an investor and over the past five decades, I've had the privilege of witnessing the intricacies of financial markets, making my fair share of mistakes, and, most importantly, learning from them. As you embark on your investing journey, I'm here to share with you the ABCs of investing, with a touch of wisdom gained through experience.

You’re saving just the right amount in order for your family to afford the necessities plus a little extra in retirement. We all dream of retirement sitting on our porch with our favorite beverage as the sun is going down, but what about the day leading up to that peaceful evening? Have you included your...

What is American Exceptionalism? There is no other country in the world that represents the blend of classical philosophy, Christianity, and even Enlightenment ideas in the way America did in the founding of the republic from 1776 to 1789. It was an exceptional (meaning uncommon) mixture of liberty, limited government, natural rights, and religious liberty...

If you have wondered: When should I start my Social Security ? Age 62... 67 or wait until 70 . What is the difference in benefits at the different ages ? I have heard that it is best to start as early as possible in case you don't live very long. If I start early how much can I earn before being penalized by Social Security ? Can I collect based on my spouse (or ex-spouse) earnings history?

Everyone has met someone who had a friend who “made a fortune on XYZ stock on a hot tip”, but much like expecting to win the lottery, expecting to cash in on a hot tip probably won’t happen for you, me, or even someone you know. Seemingly everything we do in today’s world is at...

A financial advisor is an invaluable asset to managing your finances and providing you with personalized advice specifically for you. When you begin your relationship with your financial advisor you tend to have many face-to-face interactions as the long-term relationship is being established. Once a plan is in place the meetings slow down, but don’t...

Employer-sponsored retirement plans offering a Roth 401(k) have been slow to adapt to offering the Roth 401(k) alternative to their participants. In 2011 only 49% of plans included a Roth 401(k) option, however, in 2021 that number spiked to 88%. Although subtle, there are some differences between a Roth 401(k) and a Roth IRA we...

A bucket list are activities we’d like to do before we die. Everyone has a bucket list, even if it isn’t written down. Don’t you catch yourself saying things like “one day I’d like to…” or “before I die, I’m going to…”? How will you fund those adventures if you aren’t planning for them? Frequently...