Recession is when your neighbor loses their job. Depression is when you lose yours.

Harry Truman

5 minute Video (may take a bit to load)

Takeaways from video:

- A recession can be described as a significant decline in economic activity over an extended period of time, typically several months.

- In the average recession, gross domestic product (GDP) is not the only thing declining—incomes, employment, industrial production, and retail sales tend to shrink as well. Economists generally consider two consecutive quarters of declining GDP as a recession.

- The general economic model of a recession is that when unemployment rises, consumers are more likely to save than spend. This places pressure on businesses that rely on consumers’ income being spent. As a result, company earnings and stock prices decline, which can fuel a negative cycle of economic decline and negative expectations of returns.

- As the chart below indicates we have NOT seen declines in personal income, consumption, unemployment, industrial production, non-farm payrolls, or retail sales (thus far).

How Long Do Recessions Last?

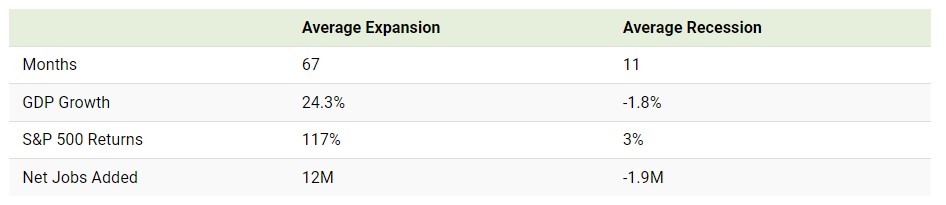

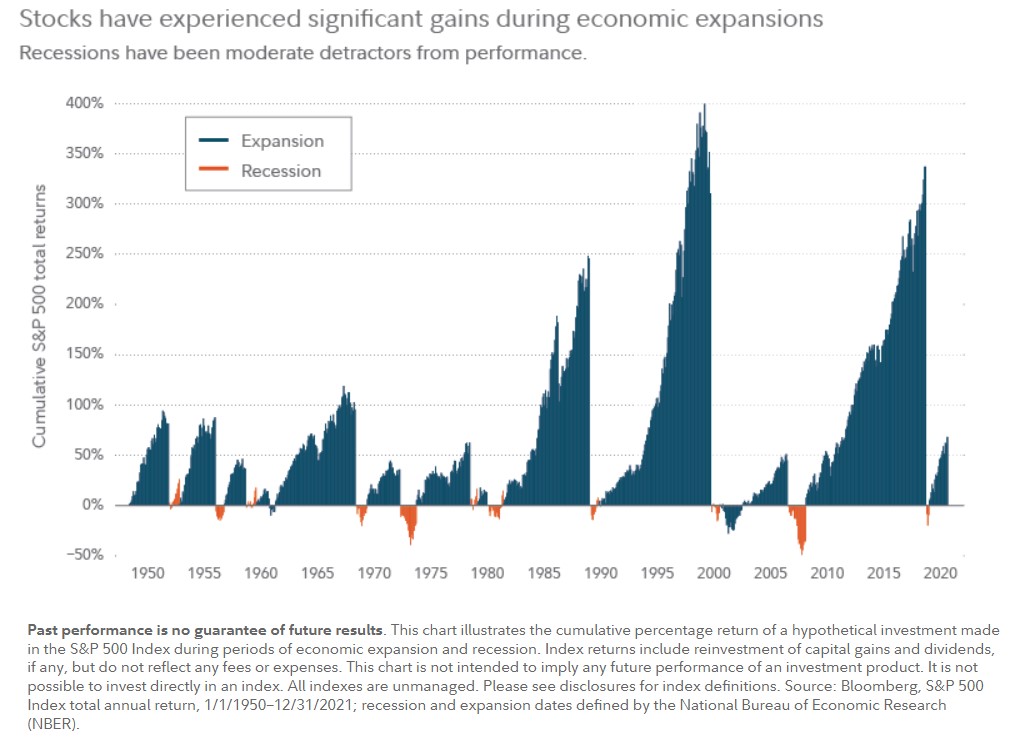

Recessions generally do not last very long. According to Capital Group’s analysis of 10 cycles since 1950, the average length of a recession is 11 months, although they have ranged from eight to 18 months over the period of analysis.

Jobs losses and business closures are dramatic in the short term, though equity investments in the stock market have generally fared better. Throughout the history of economics, recessions have been relatively small blips.

Recessions are part of economic life, more like a cold than cancer.

Just like in life, markets go through peaks and valleys. The good news for investors is that often the peaks ascend to far greater heights than the depths of the valleys.

Dave Conley, CFP