Recessions – What, When, How, Why.

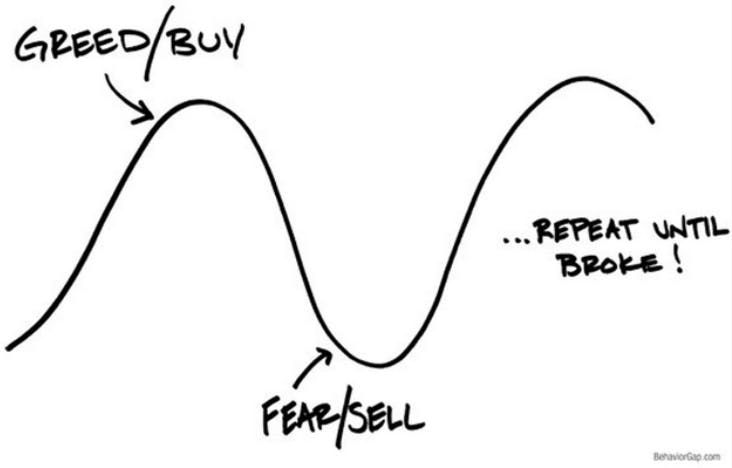

The general economic model of a recession is that when unemployment rises, consumers are more likely to save than spend. This places pressure on businesses that rely on consumers’ income being spent. As a result, company earnings and stock prices decline, which can fuel a negative cycle of economic decline and negative expectations of returns.