What are you afraid of ?

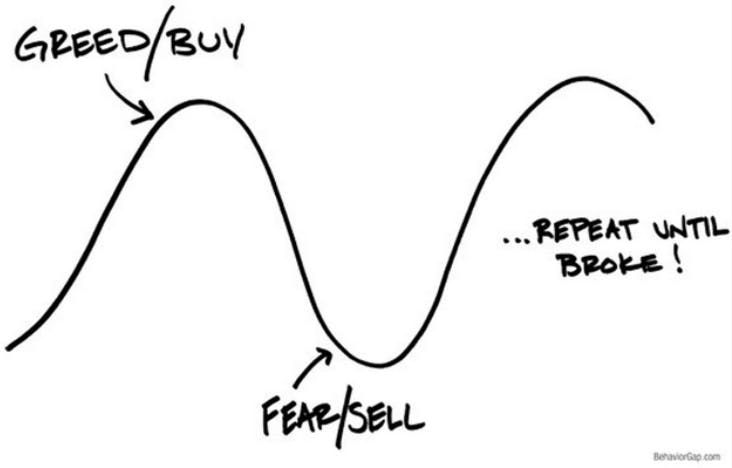

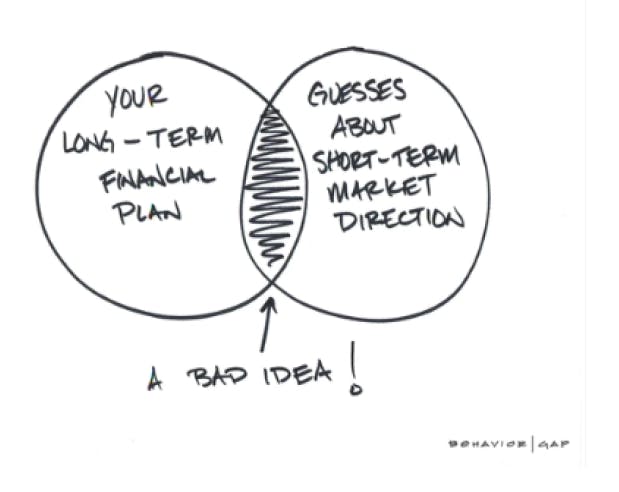

Most of us make the same mistake with our money over and over: We buy high (when the economy and markets are up) out of greed and sell low (when the economy and markets are down) out of fear, despite knowing on an intellectual level that it is a very bad idea.