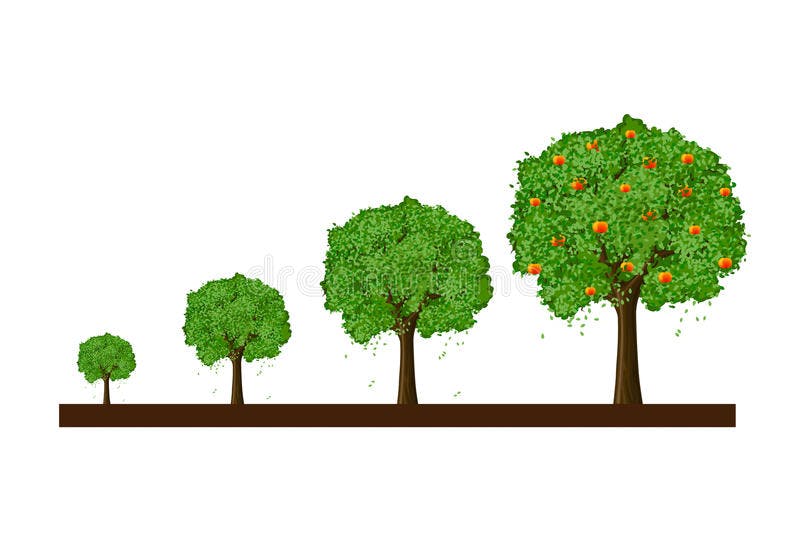

You plant a tree in your front yard in hopes that one day it will provide shade for your front porch. The cool things about trees are that Mother Nature causes them to take root, and to grow. There isn’t much you need to do. When it rains the tree is watered, the sun, the air and the environment provide everything the tree needs to grow.

Would you consider digging up the tree every 90 days to check its growth?

(Nothing much will change in that short time and eventually you will harm the trees growth)

Would you consider uprooting the tree and storing it in your garage over the winter to protect it from what you consider “bad weather”?

(Although the leaves die, and it stops growing for a season, the tree itself will not die (although it is leafless)

Give the tree enough

• Room

• Light

• Time

• And leave it alone

It will give you back air and shade and beauty as it grows… and it will go on doing so for your children, after you are gone.

That is what investing is like… if you let it be.

Growing wealth is no less organic than that tree. The growth of wealth in low cost, well managed mutual funds is no less a force of nature.

There are a few big things that really matter in successful investing (and growing trees). The SINGLE most important variable in the quest of investment success is the ONLY variable you can control: your own behavior.

Dave Conley, CFP™

Tree story taken from the book Simple Wealth Inevitable Wealth by Nick Murray

Are Social Security & Medicare in trouble – part 2