Topics this week: Inflation / Back to School Tips / Investing Even in a Bear Market

David Conley

Inflation is Primarily a Product of too Much Money Chasing too Few Goods & Services

What to expect for the remainder of 2022

There are 4 components that impact inflation:

- Supply factors – supply bottlenecks, stimulus money, and loose monetary policy.

- Demand factors – consumer, corporate & government spending on goods & services.

- US Dollar – a strong dollar will give us some greater purchasing power in the global markets and will pull down import prices.

- Money Supply Factors – Growing the money supply at greater velocity than is needed will provide the fuel for inflation.

Supply Factors

Since the onset of the global pandemic, the inflationary environment has been inflamed by supply factor-related problems with ports, international manufacturing shutdowns, and global shipping as primary challenges. These have been major factors in supply chains and inventory management. For example, auto manufacturers are still hampered with ready access to necessary components.

The good news is that as of the last inflation report, the supply factor contribution to inflation fell, and demand factor-driven contributions to inflation became more of a dominant factor.

Demand Factors

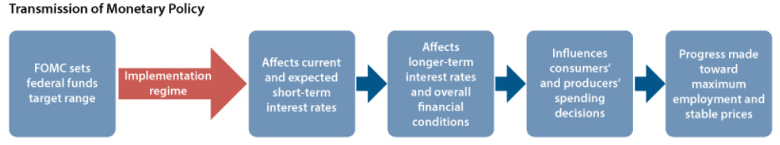

This fits perfectly into the script for the Federal Reserve. Their monetary policy tools (like raising interest rates), are blunt, but are suited for tamping down aggregate demand, and as Chair Powell himself warned, “Our tools don’t work on supply factor problems.” For example, by raising interest rates the Federal Reserve has caused mortgage rates to increase. This in turn had affected the demand for real estate reducing the demand for homes.

How the Federal Reserve raising interest rates effects inflation

Therefore rate hikes help to fight inflation only to the extent they slow the rate of economic growth (at least temporarily). This cools off the economy and thereby relieves pressure on prices. Unfortunately, the Fed’s aggressive monetary tightening (raising rates) has raised the possibility of a recession.

US Dollar Factors

A strong U.S. dollar could help ease some of the pressure off of the high prices we have right now. The year 2022 started out with import prices rising very quickly on a month to month basis.

- January, import prices rose 2.0%

- February, import prices rose 2.0%

- March, import prices rose 3.0%

These import prices were running hotter than the CPI (Consumer Price Index) over that same time-period. As the dollar has rallied in recent months, import prices have also cooled.

- June, import process rose only 0.2%, (smallest increase in six months)

Money Supply Factors

Lastly, the money supply which was growing at an unsustainable rate in 2020-2021 (+12% to +25% year vs. 6% year since 1995). M2 growth (a measure of the money supply that includes cash, checking deposits, and easily-convertible near money) has been about 1% for the past 6 month. This would suggest a strong likelihood that we will continue to see Core CPI inflation decelerate in coming months. The Fed may not have to increase rates as much as expected if inflation slows down faster than anticipated.

How is this different from the 1970’s

The current episode of Fed tightening that we are living through is fundamentally different from all the others. Why? The excess money creation that fueled the surge in inflation over the past year was a one-off event that was tied directly to the trillions of dollars of fiscal “stimulus” that our politicians pumped into the economy in the wake of the COVID lockdowns. Two years ago, the renowned economist Scott Grannis said “The shutdown of the US economy will prove to be the most expensive self-inflicted injury in the history of mankind.” He was proven true. Not only was the shutdown of the US economy pointless (as respiratory viruses cannot be contained by any known means), it was extraordinarily expensive since it thoroughly disrupted the world’s major economy and was indirectly responsible for a worldwide surge in inflation whose consequences will be felt for many more months to come.

We Expect the Fed to Pivot to Cutting Interest Rates in 2023

Preston Caldwell, Head of U.S. Economics for Morningstar expects the Fed to reverse course to easing monetary policy in 2023 as inflation falls back to the central bank’s 2% target along with the need to shore up economic growth. He projects the federal-funds rate to fall from a peak 3% – 3.5% at the start of 2023 to 1.5% by 2024. along with that, longer-term yields—including mortgage rates— should fall as well.

Falling inflation should clear the way for the Fed to cut interest rates. He is projecting price pressures to swing from inflationary to deflationary by 2023, owing greatly to the unwinding of price spikes caused by supply constraints in durables, energy, and other areas. He projects inflation to average just 1.5% over 2023 through 2026.