“Awareness is like the sun. When it shines on things, they are transformed.”

Thich Nhan Hanh

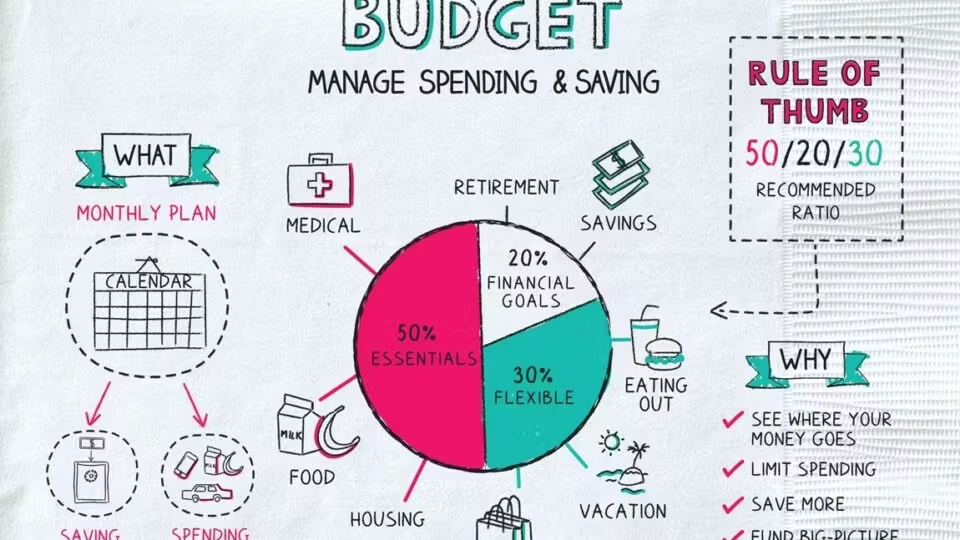

Becoming aware of our spending is one of the most powerful tools we have. Why? In examining our spending we become aware of ourselves. Budgeting is simply being aware of our spending. Why is this keeping track of how we spend our income important?

“Your income (cash flow) is your GREATEST wealth building tool.”

Dave Ramsey

There are very few people who love to budget. And when it comes to co-budgeting with a spouse or partner, there’s a good chance at least one of you will actually hate the idea. Yet anyone who takes the time to think about it would agree that spending money in a way that’s more aligned with our values will bring us more happiness.

“Don’t tell me where your priorities are. Show me where you spend your money and I’ll tell you what they are.”

James Frick

So since most people would agree that being intentional is our spending is important, why aren’t more people budgeting (spending with intentionality)?

- It’s no fun. Absolutely true. In his book, The 7 Habits of Highly Effective People, Stephen Covey says, “If the ladder is not leaning against the right wall, every step we take just gets us to the wrong place faster.” Budgeting is how we make sure our spending ladder is leaning against the right wall.

- I already know where my money is going. (liar, liar, pants on fire) Sorry. Unless you track your spending (aka budgeting), you don’t have a clue where your money goes. I have never seen someone go through the process of tracking spending for 30 days who doesn’t end up saying something like, “I had no idea I was spending that much on X.”

- I’m not sure I want to know. This is probably the biggest hurdle. The truth is that AS WE become aware of what and how we’re spending, we’ll find some things that surprise and bother us.

Do you want to become more intentional with your spending? Do you want to change the financial trajectory of your life… it starts with managing cash flow (budget). That process starts by tracking your spending.

So how does one do this? What is the best app? The best software?

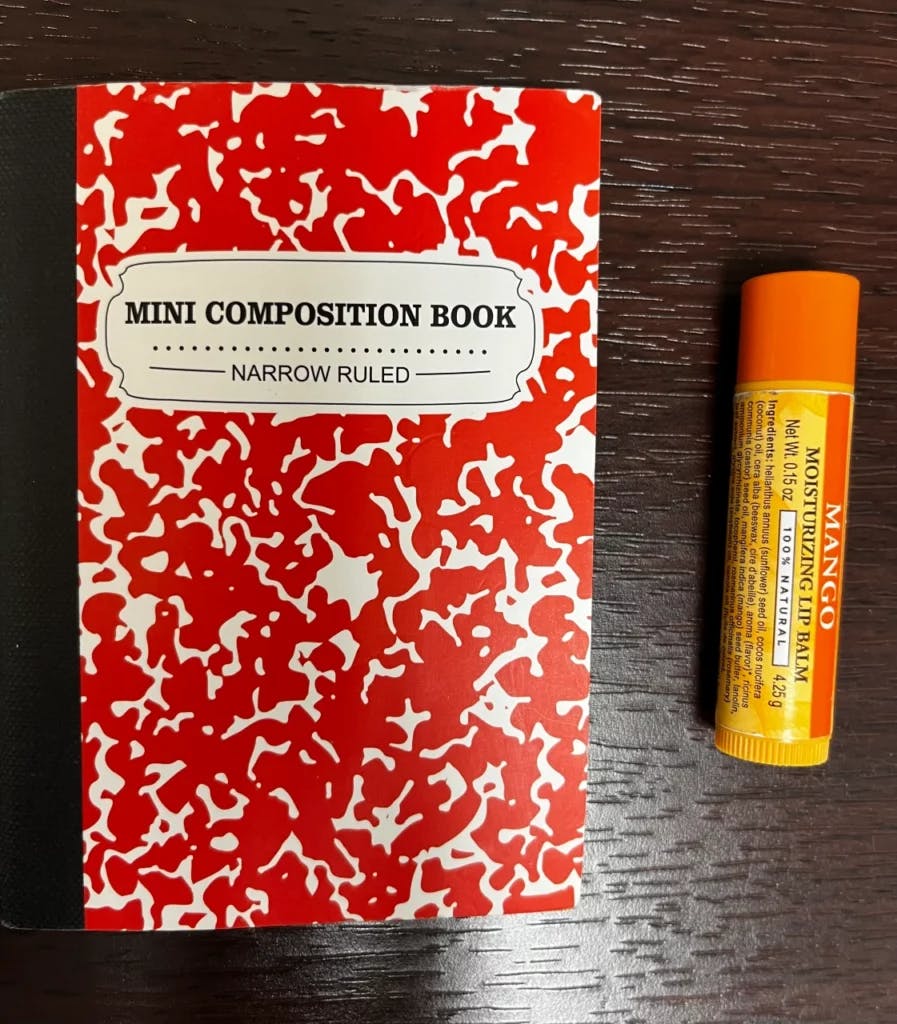

Below is a picture of the best FREE app I am aware of and I have a supply of them available at no cost at my office just for the asking.

“Start where you are. Use what you have. Do what you can.”

Arthur Ashe

No Excuses. Give it a try Try tracking your spending for 30 days.

1- Just carry around a pen and a little notebook, each time you make a purchase, write down what you spent and how it made you feel. Bills paid online or by check, what you spent and how it made you feel.

2- At the end of the month, go back through your notebook and just notice. Become aware. That’s it.

If we can answer any questions or if you want one of these notebooks call 864-862-9279 or stop by our office.

Dave Conley, CFP