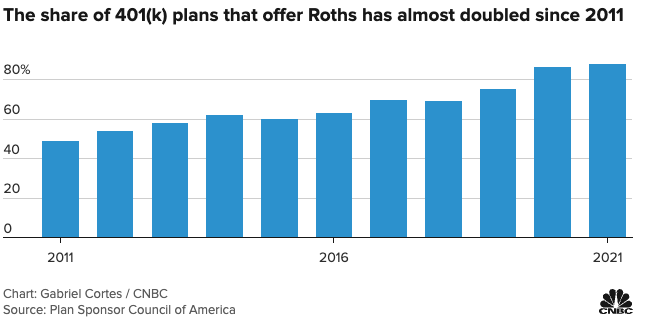

Employer-sponsored retirement plans offering a Roth 401(k) have been slow to adapt to offering the Roth 401(k) alternative to their participants. In 2011 only 49% of plans included a Roth 401(k) option, however, in 2021 that number spiked to 88%.

Although subtle, there are some differences between a Roth 401(k) and a Roth IRA we should discuss further.

Roth vs. Traditional

If you are unaware, a Roth (be it 401k or an IRA) account is funded with already-taxed income, whereas a traditional 401k or IRA is considered tax deferred. The draw to the tax-deferred accounts is the fact you can reduce your taxable income as you don’t pay taxes on your contributions (until you begin withdrawals in the future).

Contribution Limits

For 2023 the contribution limit on Roth IRAs was increased to $6,500 for those under 50 with an additional $1,000 “catch-up” allowed for those over 50.

Roth 401(k) contribution limits are much higher, with those under 50 being able to contribute $22,500 this year, and $30,000 for individuals over 50.

Another bonus of a Roth 401(k) is that there are no income limits on your eligibility to contribute, while Roth IRA accounts have limits on income before beginning to restrict contributions ($138,000 for individuals and $218,000 for married filing jointly).

Rollover Eligibility

You are able to roll a Roth 401k into a Roth IRA; however, you cannot roll a Roth IRA into a Roth 401k.

Qualified Distributions

To meet qualified distribution guidelines (being able to withdraw funds tax-free) you must have begun contributions to the plan at least five years prior. There are exceptions within Roth IRAs that allow you to make qualified distributions early such as a first-time home purchase, college expenses, as well as birth and adoption expenses.

Those exceptions do not apply to Roth 401(k) plans.

Non-qualified Distributions

Roth IRAs offer the ability to withdraw funds before you turn 59 and a half, and due to the ordering rules of Roth IRAs, your contributions are withdrawn first, with taxable earnings only coming out after all of your contributions have been withdrawn.

Roth 401k accounts do not offer the same, as a portion of each non-qualified distribution will be taxed.

RMDs

Roth IRAs have never had required minimum distributions (RMD), however, only recently with the passing of the SECURE 2.0 Act in 2022 will this change for Roth 401k accounts. Starting in 2024 you will no longer be required to take RMDs from your Roth 401k.

RMDs will still apply to your beneficiaries, typically in the form of the 10-year payout period rule.

If you have any questions or want to discuss anything further, reach out via email, by phone, or schedule a meeting with Dave or me.

References

https://www.cnbc.com/2022/12/16/88percent-of-employers-offer-a-roth-401k-how-to-take-advantage.html