If you are like the typical pre-retiree that comes into our office, you are probably wondering:

- When should I start my Social Security ? Age 62… 67 or wait until 70

- What is the difference in benefits at the different ages ?

- I have heard that it is best to start as early as possible in case you don’t live very long.

- If I start early how much can I earn before being penalized by Social Security ?

- Can I collect based on my spouse (or ex-spouse) earnings history?

When you should start your Social Security depends on a number of factors. There is no single right answer for every person. Ask yourself the following questions:

- Will you continue to work ? If you continue to work your Social Security benefits increase by about 8% for every year you delay starting Social Security. In addition their may be tax penalties if you start Social Security early, while still working.

- Why do you want to start early, do you need the money? If you have other investments you can use to support yourself and delay starting Social Security it will continue to grow your benefit at about 8% a year. That is not the kind of guarantee you can get from any other investment.

- If you are married, is there an age difference ? If there is a large age gap between you and your spouse and you die, your spouse will either get your benefit or theirs (whichever is greater). This means that if the younger spouse has a substantially smaller benefit than the older we typically encourage the older spouse to delay as long as possible (maximizing the benefit for the younger spouse). The younger spouse would typically start their Social Security as early as possible (assuming they are not working).

- What is your health like ? It is important to evaluate your health and likely life expectancy. If you have a health condition that will likely shorten your life expectancy then that is a primary factor in determining when you start your Social Security.

What is the difference in your benefits at various ages? In the past we waited for Social Security to mail us a flyer every year near our birthday. That is not needed today as we can register on the Social Security website and get our benefits immediately. See the link below to Register and review your benefits.

Register / Create a Social Security account online

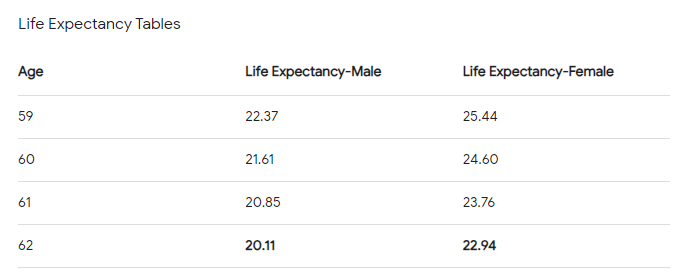

I have heard that it is best to start as early as possible in case you don’t live very long. Its funny but most people underestimate their life expectancy and therefore self-justify starting Social Security early. The facts are shown below, the life expectancy of someone with average health if you are currently:

The facts are that starting at age:

- Age 62 is the best option if you intend to die before age 75

- Age 67 is the best option if you intend to die before age 80

- Age 70 is the best option if you expect to have a normal life expectancy

If I start early how much can I earn before being penalized by Social Security ? If you start Social Security before full retirement age (67 for most of us born after 1960) there is a limit on how much you can EARN (via a job with a W-2 / 1099) without being penalized. In 2023 that limit on EARNINGS is $21,240 (remember not all income is considered earnings).

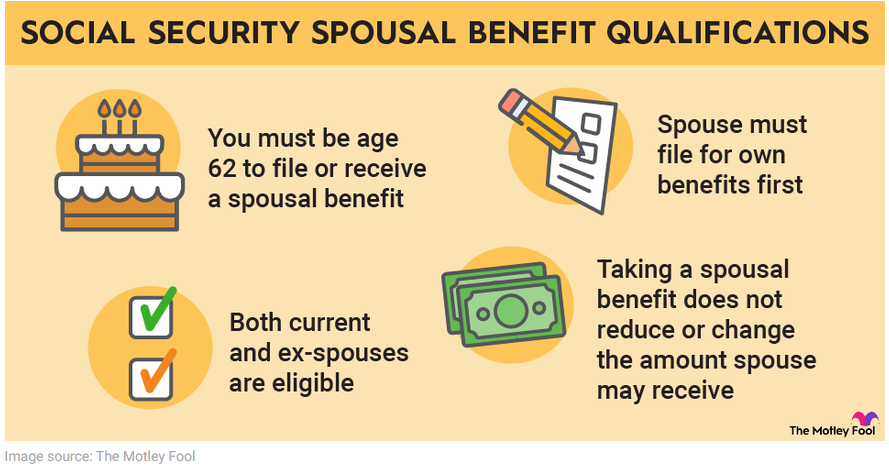

Can I collect based on my spouse (or ex-spouse) earnings history? Yes. you can collect and improve your Social Security income based on your spouses earning history.

If you are still working and earning Social Security credits BUT your benefits will be substantially lower than your spouses (Spouse age 67 receives $3,500 month but your benefit at age 65 is $1,300 month. By filing at age 65 you would receive the greater of your earned benefit ($1,300) or 41.7% of your spouses $3,500 month benefit ($3,500 x 41.7% = $1,459.50 month).

Wow, that is a lot to take in isn’t it! Are you confused yet?

If you are age 60 or older you will likely receive:

- An invitation to a steak dinner at a local restaurant and be told you will learn the “secrets” to getting the most from your Social Security

- An invitation to free classes held at the local community college, library or Chamber of Commerce for an “educational” seminar on Social Security.

These are BOGUS, and you have been around long enough to understand nobody does anything for free. These are merely ways for annuity or life insurance salespeople to get in front of people who are preparing to retire so they can sell you a product.

Listen, if you have a competent advisor who is a Certified Financial Planner™ they will be able to explain your options and assist you in determining the best time for you to start your Social Security. If you do not have an advisor or would like a second opinion please contact one of our advisors at the Master’s Financial Group. We would be happy to speak with you ans determine if we might be a good fit for you. You can reach us by phone at 864-293-7452, by email at [email protected] or via our website https://myupstateplanner.com/schedule-call/

Dave Conley, CFP