A financial advisor is an invaluable asset to managing your finances and providing you with personalized advice specifically for you. When you begin your relationship with your financial advisor you tend to have many face-to-face interactions as the long-term relationship is being established. Once a plan is in place the meetings slow down, but don’t forget that life happens, plans change, goals change, and opportunities arise that you may need advice on!

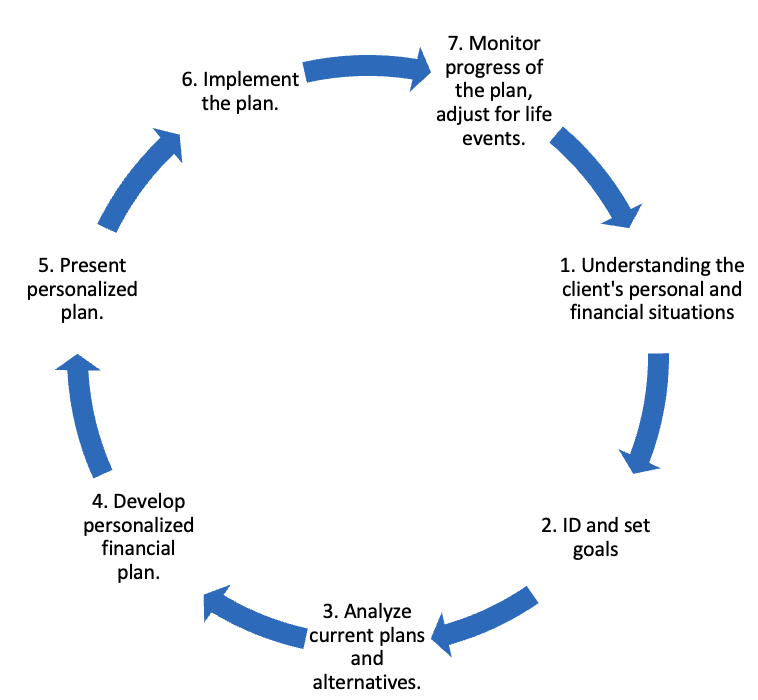

The following graphic shows how the financial planning process goes. As you can see, planning is not linear, it is cyclical. Almost anything you’d categorize as a “life event” could trigger a required/suggested change in your financial plan.

Developing a Diversified Investment Portfolio

Your financial advisor will help you build a diversified investment portfolio that spreads your investments across a range of assets, including stocks, bonds, mutual funds, and other investment vehicles. Diversification helps reduce the risk of your portfolio by minimizing the impact of any single investment.

Monitoring and Rebalancing Your Portfolio

Once your investment portfolio is established, your financial advisor will monitor it regularly as the market changes to ensure it is performing in line with your goals and risk tolerance and rebalance your portfolio when it is not.

Tax Planning

Your financial advisor will help you with tax planning, which involves identifying strategies to minimize your tax liability. This can include maximizing contributions to tax-advantaged accounts, such as IRAs and 401(k)s, and taking advantage of tax-loss harvesting.

Retirement Planning

A financial advisor will help you plan for retirement by developing a retirement savings strategy and estimating how much you will need to save to achieve your desired retirement lifestyle. They can also help you determine when to start taking Social Security to ensure you maximize your benefits and how to manage your income and expenses in retirement.

Family Planning

The cost of raising a child increases constantly, as younger families prepare for a child, they typically think of the obvious items like babyproofing the living room, buying a crib, and stocking up on diapers, however, planning for college does not have to be an afterthought! Your financial planner can help you determine how to fund your child’s tuition before they are even born.

Estate Planning and Life Insurance

Your financial advisor will help you with estate planning, which involves creating a plan for the transfer of your assets to your heirs or beneficiaries after your death. This can include creating a will, establishing trusts, and minimizing estate taxes. Depending on your situation, your financial advisor may recommend an increase or decrease in life insurance as well.

If you have any questions please give us a call or schedule a time to sit down with us.