People haven’t been this negative about the economy & investing since 2010.

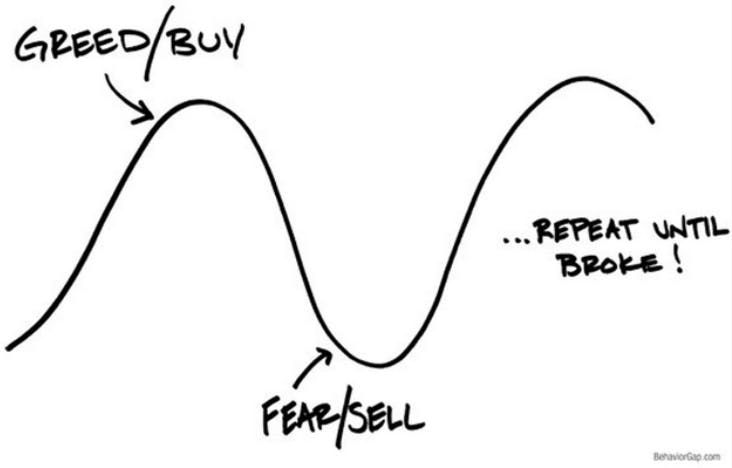

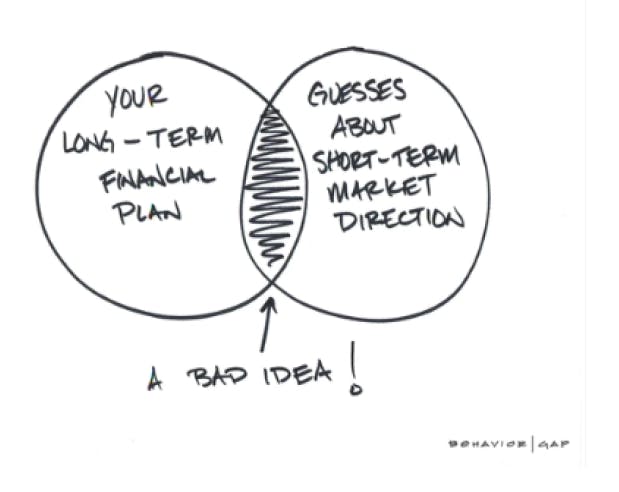

Just like we do not know when we are in a recession (until after it has started), the markets begin their recovery in the midst of bad news. It is critical top your wealth to understand this fact: the markets (stocks & bonds) typically reflect where the economy is headed in 3-6 months from today. If you wait for the news to tell you the markets have recovered, the economy has turned around you probably missed out on a good portion of the initial recovery.