This is a very common question among those contemplating starting their investment journey. They wonder if their $20 a week would amount to anything and if they should wait until they can invest $50 or $100 a week. Let’s look at the numbers.

- The minimum investment required for a balanced fund is as little as $250. We define a generic balanced fund / ETF as being 60% equities (S&P 500), 40% bonds (US Bond Market).

- This would take 13 weeks, or three months and one week, to accumulate at $20 a week.

- The total amount invested over 20 years is $19,370, this includes the $250 initial deposit and $20 every week.

Can you guess how much that $19,370 could be worth today based on historical averages with this type of an investment? (Reminder, this is a balanced fund, not aggressive AND these are historic returns. Obviously future returns can be better or worse).

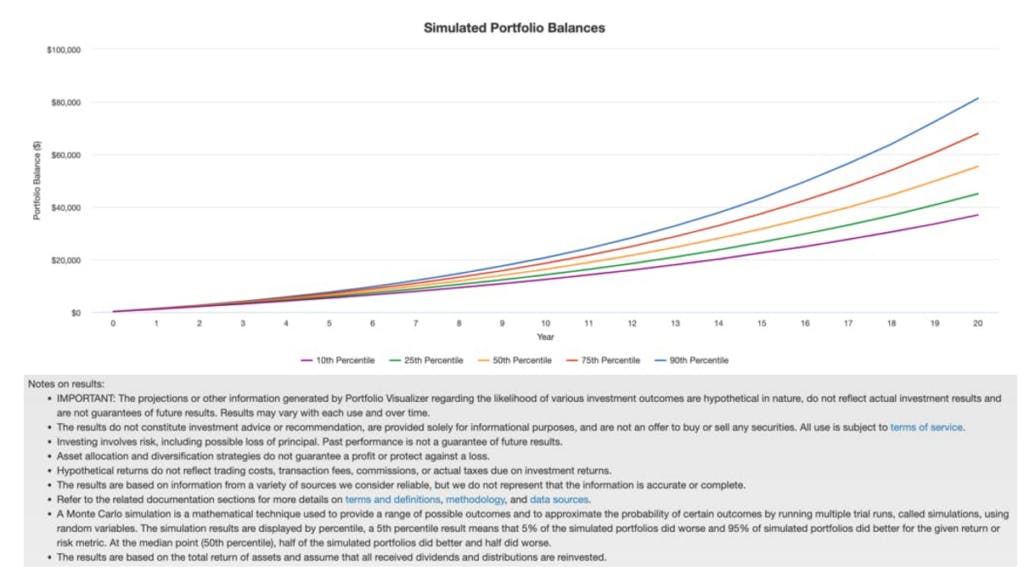

Utilizing a Monte Carlo Analysis of historical rolling 20 year periods, the very least the investment performed over any given 20-year period between 1987 and 2021 was $36,000.

The median for each 20-year period? $55,000.

The best 20-year period would garner a portfolio value of $81,000.

To answer your question, yes, it is worth investing even if you can only spare $20 a week.