How much of your retirement savings can you safely spend each year?

Retirement is a stage of life that everyone looks forward to, after years of hard work and saving. However, the key to a happy retirement is having enough money to sustain you during this phase of your life. One of the most important decisions you will make during your retirement is how much of your savings you can safely spend each year. In this blog post, we will outline the top 5 retirement spending strategies that retirees can use to plan their retirement spending.

The 4% Rule: The 4% rule is one of the most popular retirement spending strategies. According to this rule, you can withdraw 4% of your retirement savings in the first year of retirement and increase the withdrawal amount by 3% each year to account for inflation. This strategy assumes that you will have a balanced portfolio of stocks and bonds and that your portfolio will last for 30 years.

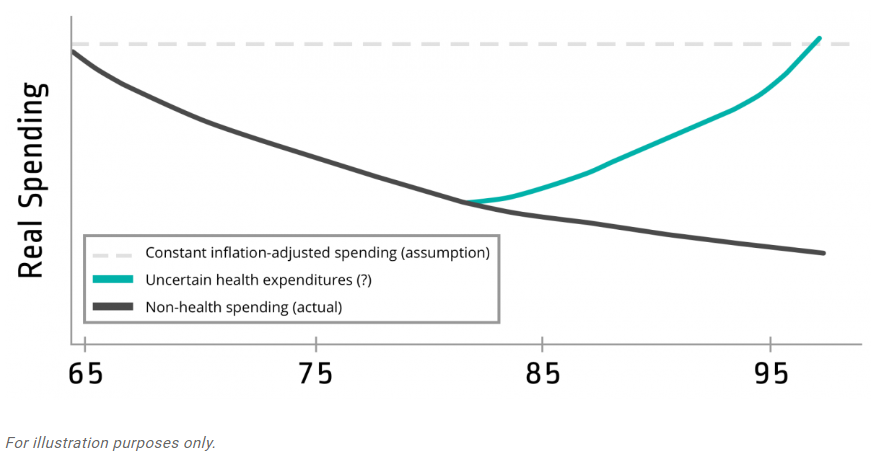

Retirement Spending Smile: Retirement spending tends to gradually decrease during retirement. Early in retirement while we are still spry and energetic enough to travel, or we tend to make up for lost time on our (expensive) hobbies that were put to the side before retirement. As we get older, we tend to slow down and get more sedentary. This often translates to a decreased desire to spend. And then towards the end of our live there are a increased medical expenses that we will likely need to contend with. Using this strategy retirement expenses will be increased by the general rate of inflation minus a specified % reduction. Annual health care costs will be adjusted by the health care inflation rate.

The Bucket Approach: This approach involves dividing your retirement savings into three buckets: a short-term bucket for expenses in the next 3-5 years, a medium-term bucket for expenses in the next 5-10 years, and a long-term bucket for expenses beyond 10 years. The idea is to invest the short-term and medium-term buckets in more conservative investments, such as bonds, to preserve your capital and generate a steady stream of income. The long-term bucket can be invested in more growth-oriented investments, such as stocks, to provide the potential for higher returns.

Retirement Spending Stages: This approach involves dividing your retirement into three stages: the go-go years, the slow-go years, and the no-go years. During the go-go years, you can spend more freely and enjoy the fruits of your labor. During the slow-go years, you may need to cut back on spending and live on a more modest budget. During the no-go years, you will primarily rely on your fixed income sources, such as Social Security and pensions, to support your basic needs.

The Percentage of Portfolio Approach: This approach involves spending a fixed percentage of your portfolio each year, regardless of market conditions. For example, if you have a $500,000 portfolio and plan to spend 5% each year, you would withdraw $25,000 in the first year of retirement ($500,000 x .05). The advantage of this approach is that it provides a steady and predictable source of income, but it also means that you may need to adjust your spending if your portfolio value decreases significantly.

In conclusion, there are many retirement spending strategies to choose from, and each retiree should choose the strategy that best suits their individual needs and goals. It is important to seek professional advice to help you make informed decisions about your retirement spending and to ensure that your retirement savings last as long as you do.

If you would like a no cost evaluation of your retirement and which spending strategy might be right for you please call 864-293-7452 or email our office [email protected] to schedule a meeting.

Dave Conley, CFP