How many times during a discussion about finances have you heard someone say, “Investing in the stock market is just like gambling at a casino“? It is true that investing and gambling both involve risk and choice—specifically, the risk of capital with hopes of future profit. While investing and gambling have a few similar characteristics, they are very much different. An investor know that buying stock is buying ownership in a company. Buying shares of a company is equivalent to having a claim on the assets, debts, and, more importantly, a small fraction of the company’s profits whose shares you buy. If you own shares in Proctor & Gamble (PG) then every time someone buys a box of Tide or a bottle of Febreze then you make a small percentage of the profit.

Take the quiz below to help you decide.

- Are you measuring your returns (investment success or failure) over a short amount of time? Rather than planning to invest over years (1, 5 or 10+), you want to see a return within months, weeks or even days.

- Are you investing (or staying away) based on feelings, elections or fears? No one knows what the market is going to do tomorrow (let alone any one individual security in that market). If you base your investments off of predictions, forecasts or what someone else told you was going to happen… that’s speculating, not investing.

- Are you letting emotions dictate your investing strategy? Humans are highly emotional, irrational decision-makers. There’s nothing we can do to change that — but we can plan for it by putting an investment strategy in place and then sticking to that strategy.

- Are you of the opinion that you know something the “market” doesn’t? An efficient financial market means that the securities within that market are accurately priced. But gamblers believe they have some sort of information the rest of the market doesn’t have. If you think you know more than the millions of other market participants and all the data that flows in and out of that market to determine individual prices … A. you’re probably wrong, and B. you’re gambling.

So based on the short (non scientific quiz), are you an investor or a gambler? It is important to understand what you are doing: investing, playing around, or gambling (aka speculating).

A good financial planner can help you determine how (and how much) of your investable assets should be invested based on your financial position, goals and risk tolerance. It might be OK to take 5% of your available funds and speculate with investments appropriate for your situation. A competent financial planner can provide an objective, third-party opinion on how much you can safely use to speculate with stocks or other investments.

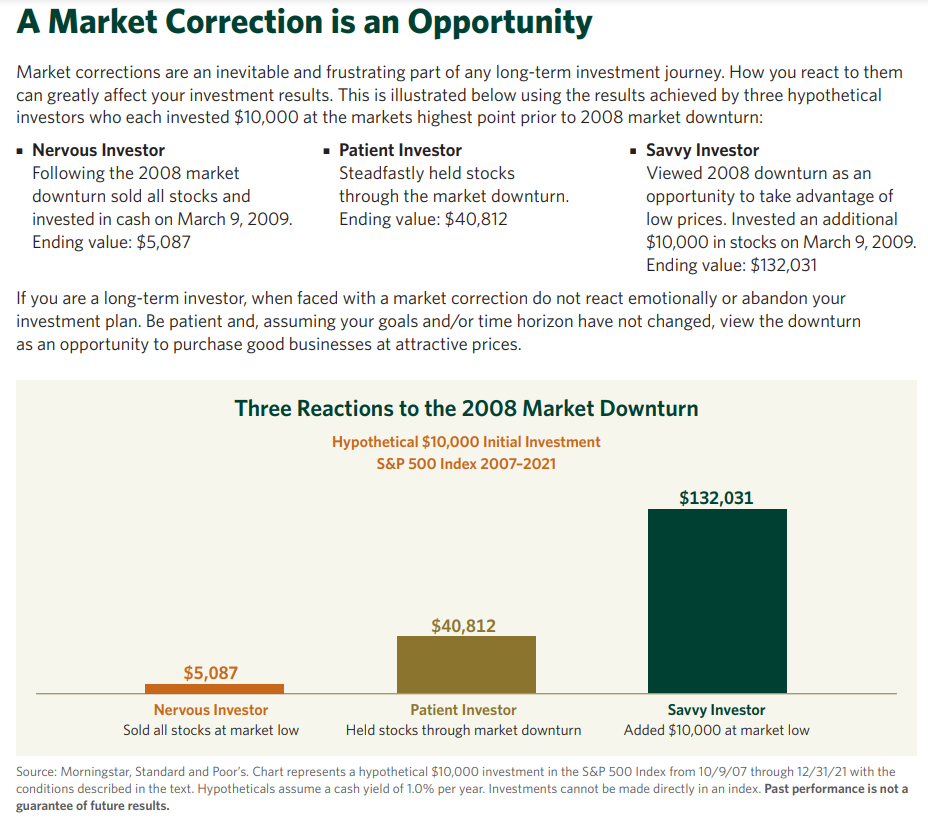

What’s the difference between investing in the stock market and speculating? In simple terms, speculators are trying to out-smart the markets while investors simply participate in the markets. The investment time horizon is also a very important factor as speculation tends to be over the short-term while investing is over the long-term. When the price of an high quality investment drops the speculator is looking for how to exit (sell) the investment. An investor understands that during many down markets the prices of market investments do not reflect their true value, just what people are willing to pay for the investment… right now. An investor believes that when the investment “goes on sale” it might be a good time to stock up rather than sell what they have at a discount.

“A market downturn doesn’t bother us. It is an opportunity to increase our ownership of great companies with great management at good prices.”

Warren Buffet, Chairman Berkshire Hathaway

An investor (even a retiree who is invested) views a market correction as an opportunity.

Do you have questions about your investments, the markets, economy, taxes… schedule a call or meeting with us by calling our office (864) 862-9269 or going to our website and requesting a call

Dave Conley, CFP