We’ve discussed how people think they don’t have enough money to invest, so instead, they spend what they could have saved.

But, what about those who are not yet investing, the ones who are on Dave’s Baby Step 2: pay off debt utilizing the debt snowball method?

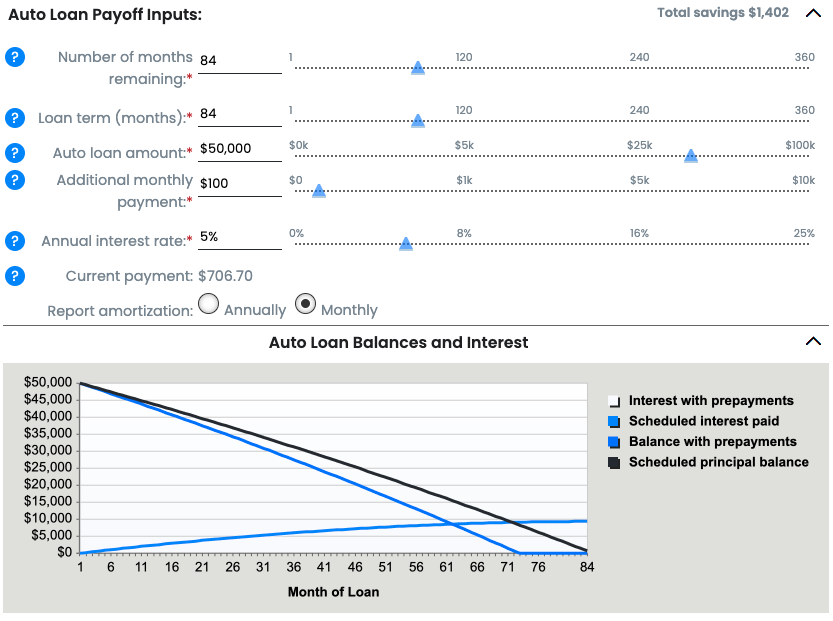

I know a lot of people reading this couldn’t imagine paying over $800 a month for a car payment, however, the average cost of a new car is nearing $50,000!

As loans increase in size, borrowers tend to lean toward a longer payoff term to save money each month.

So, let’s pretend you just purchased a brand-new full-size SUV and after trading in your previous vehicle your loan comes out to be $50,000.

- You select an 84-month loan to reduce the monthly payments.

- You receive a 5% annual interest rate.

- Your payments are $706.70.

After completing your new budget, you notice there is still $100 left over per month. What would applying that $100 to your loan principal do, if anything? (Click here for visual)

- Over the life of the loan, you would save $1,402 in interest.

- You would pay off that loan 11 months early, allowing you to invest those funds sooner.

That does not seem like a HUGE impact, does it? No, but you did not drastically adjust your budget, nor did you leave $100 unallocated to be wasted monthly.

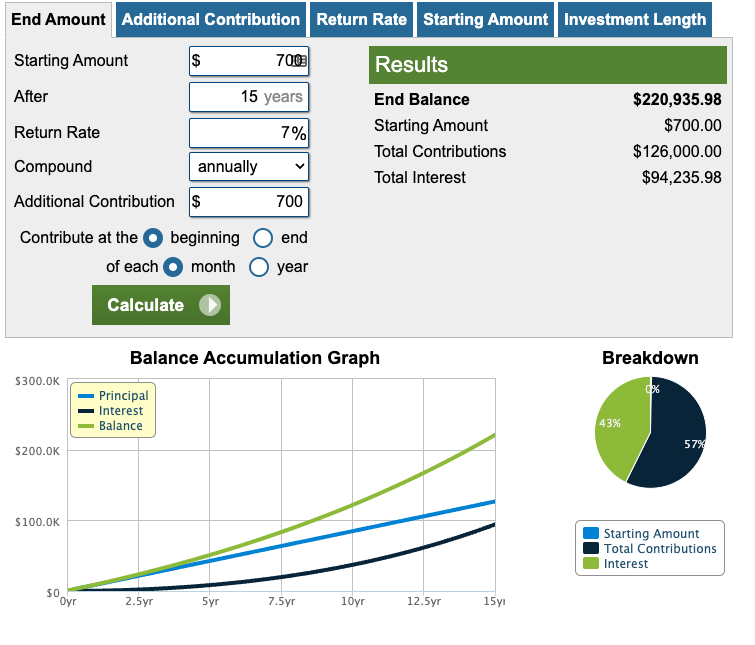

Once you pay off the loan, let’s say you invest most of what you were paying, so $700.

$700 a month invested with an ROI of 7% over 15 years (click here for visual):

$220,935

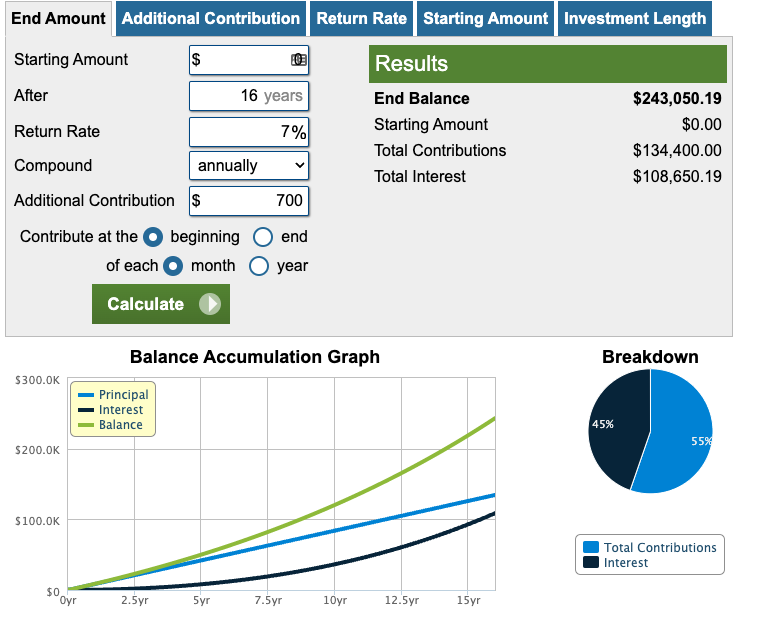

$700 a month invested with an ROI of 7% over 15 years and the extra 11 months (click here for visual):

$243,050

$22,115 more in your retirement sounds better than $100 extra a month in your pocket now, doesn’t it?

Contact Dave or me if you’re looking for some budgeting or investing advice!

Early Payoff ($100/month)

Investing $700 for 15 years

Investing $700 for 15 years and 11 months