Tag: Masters Financial Group

When conversations navigate toward the topic of retirement, one of the most common subjects discussed is IRAs. If you are unaware, IRA stands for individual retirement account, meaning it is not offered through your employer, you made a choice to start saving into a retirement account on your own. Traditional IRAs are invested pre-tax, and...

The hamster wheel literally describes the concept of lots of activity but making no progress. In times of crisis, either real or imagined we are encouraged to do something. If your house is on fire or if you witness a car accident you must do something and quick. Why is it that doing nothing when it comes to our investments is so difficult. When clients ask "what are you doing..." sometimes the better question is "is there anything that needs to be done" related to our investments? Are you OK with doing nothing when nothing needed to be done?

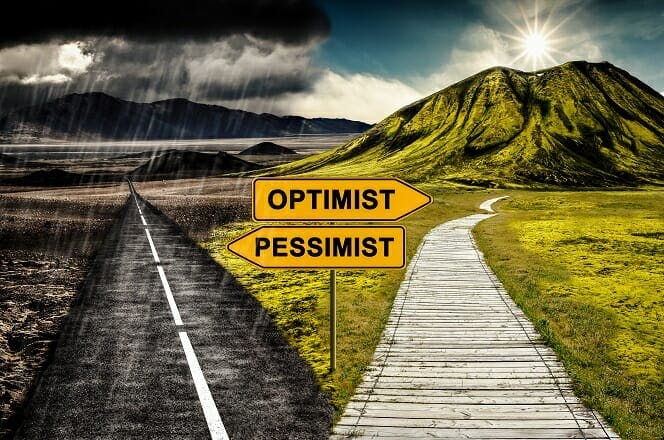

Ralph and Betty recently bought a new Ford Explorer SUV for $40,000, after carefully research before the purchase. Surprisingly, over the next few months they began to receive offers to buy the vehicle from them at smaller and smaller amounts of money. As far as they knew the vehicle was still in great shape, it had a few thousand miles on it, a ding or two but apart from that the engine still purred and ran like it did when they bought it. Still, Ralph and Betty considered selling the Ford Explorer for half of what they paid for it because they worried that something might be wrong. Should they have sold the vehicle?

I’ve been asked many times “if Dave Ramsey says to fund a Roth IRA, why would I ever choose a traditional IRA”? Well, much like any advice, there is no absolute in reference to what will work best for everyone in every situation. Let’s examine the main characteristics of both types of IRAs. As...

Have you been fearing that you will be living in poverty in your golden years because news articles and studies have long stated that Americans do not know how to save or don’t save enough? In 2002 the Economic Policy Institute study reported that 40% of households then aged 47-64 would retire on less than...

Just like we do not know when we are in a recession (until after it has started), the markets begin their recovery in the midst of bad news. It is critical top your wealth to understand this fact: the markets (stocks & bonds) typically reflect where the economy is headed in 3-6 months from today. If you wait for the news to tell you the markets have recovered, the economy has turned around you probably missed out on a good portion of the initial recovery.

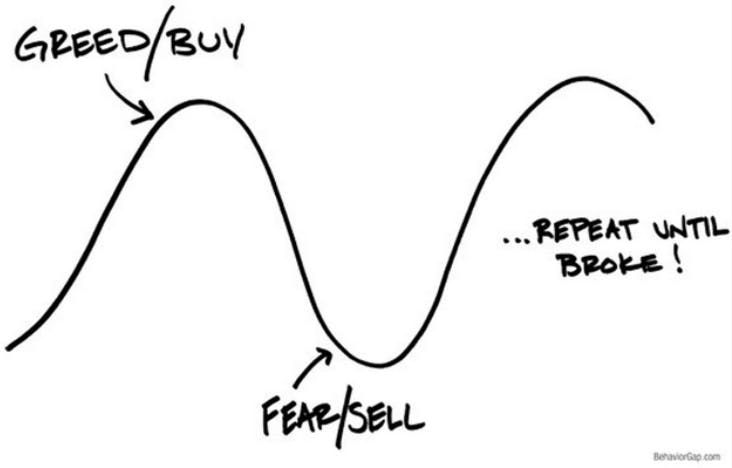

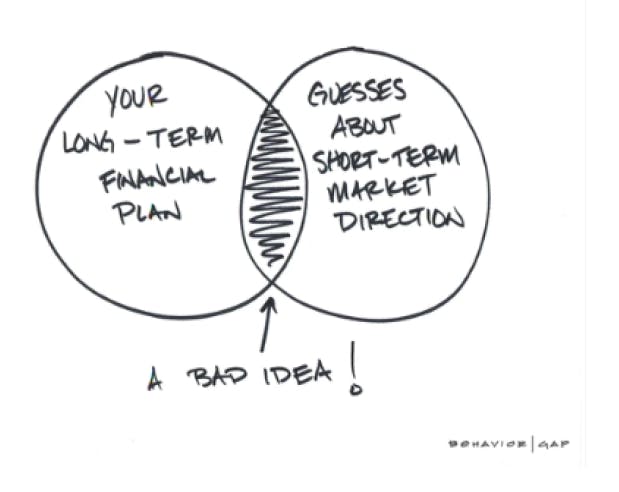

Most of us make the same mistake with our money over and over: We buy high (when the economy and markets are up) out of greed and sell low (when the economy and markets are down) out of fear, despite knowing on an intellectual level that it is a very bad idea.

Each and every month we get a question that is similar to the statement above. The questions are sincere but based on the assumption that one can invest in the markets painlessly. What I mean by that is I can get marketlike returns when the market is going up, then jump out of the market...

$10,000 is still $10,000 = Capital Preservation $10,000 still buys what it did = Purchasing Power Preservation The distinction is vital to your long-term wealth! Not a month goes by that we do not have a call where someone inquires about investing and includes the phrase, “but I don’t want to lose my money“. The...

We all work hard. Some of us work four 10-hour days. Some work five 8-hour days. Some choose to work 12-hour days all the time. But whatever you do… you put in labor and expect a fair return for your effort. You use that return to plan, budget, and live life to the fullest. Back...