There should be no shock to you when I state that 2022 has been a tumultuous year for the stock market.

Seemingly everything that could happen to negatively affect the market, has. The lingering pandemic, inflation, monetary policy tightening by the Federal Reserve, Russia invading Ukraine, investor panic, and the cyclical mid-term election impact….?

Mid-term election years are generally worse than the other three years of a presidency. Add that to with the factors mentioned in the previous paragraph, and you have 2022’s stock market.

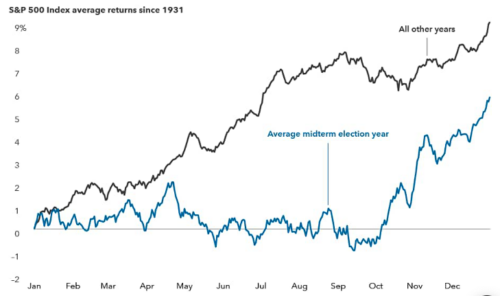

The S&P 500 Index has historically underperformed in the year leading up to midterm elections. The average annual return of the S&P 500 in the 12 months before a midterm election is 0.3%—significantly lower than the historical average of 8.1%.

Check out the chart below for a visual aid from Capital Group, RIMES, and Standard & Poor’s:

So what does that mean for us as we potentially “turn the corner” in 2022/2023?

You must have known there was going to be a silver lining somewhere in this blog…

The 12-month period after the mid-term election averages a return of 16.3% (Data source: U.S. Bank Asset Management Group research, Bloomberg, October 31, 1961-December 31, 2021). As always, past performance is no guarantee of future results, and the opinions presented cannot be viewed as an indicator of future performance.

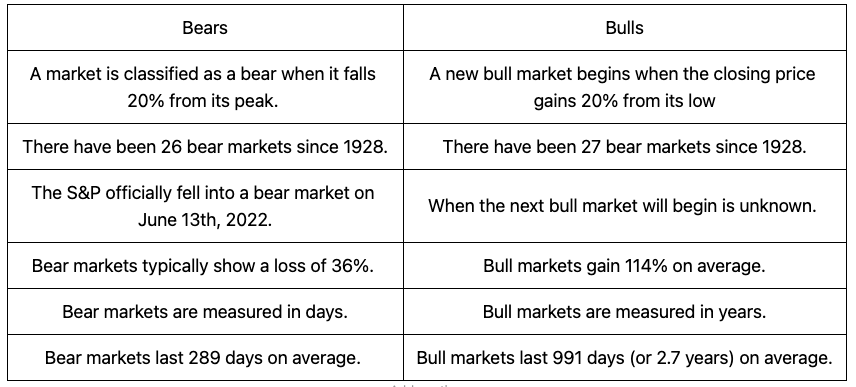

Want to know about Bears vs Bulls?

- Half of the S&P 500 Index’s strongest days in the last 20 years occurred during a bear market.

- Another 34% of the market’s best days took place in the first two months of a bull market—before it was clear a bull market had begun. In other words, the best way to weather a downturn could be to stay invested since it’s difficult to time the market’s recovery.

- The “buy low, sell high” adage comes off the tongue much easier than sticking to the strategy, especially in a bear market, right? But the concept is easily understood when we talk about it, try to remember this as you feel uneasy about the market today.

No one knows when the market is going to turn around, and don’t believe anyone if they tell you they do. What we do know is history, and every indication is that a brighter economic state is more probable than not.

References

10 things you should know about bear markets. Hartford Funds. (n.d.). https://www.hartfordfunds.com/practice-management/client-conversations/managing-volatility/bear-markets.html?fbclid=IwAR1jVaep8LAt78iTiRyJI3ZNnDddYqxKRYky4rn3HPKTk7rzX_MS61Zh8Bs

Klebnikov, S. (2022, June 29). Stocks are crashing but history shows this bear market could recover faster than others. Forbes. https://www.forbes.com/sites/sergeiklebnikov/2022/06/29/stocks-are-crashing-but-history-shows-this-bear-market-could-recover-faster-than-others/?sh=5ef6f1b05cc2

Miller, M., & Buchbinder, C. (2022, September 8). Can midterm elections move markets? 5 charts to watch. Capital Group. https://www.capitalgroup.com/advisor/insights/articles/midterm-elections-markets-5-charts.html