- Currently 66 million individuals receive a monthly benefit from Social Security

- 75% of those receiving a monthly check are retirees (49 million)

- The age you begin collecting your Social Security has the HUGE impact on your expected benefit

- Starting at age 62 or 63 is the best option for only 1 of 15 individuals (6.5%) who are eligible to collect Social Security

- About 40% of individuals start their Social Security at age 62 or 63

What determines the amount of your Social Security benefit?

- Work & earnings history – The Social Security Administration (SSA) use your highest (inflation adjusted) earnings years. What if you only worked for 30 years? The SSA uses $0.00 for each of the 5 years you did not work. The first thing one can do to maximize their Social Security benefit is to work for 35 years.

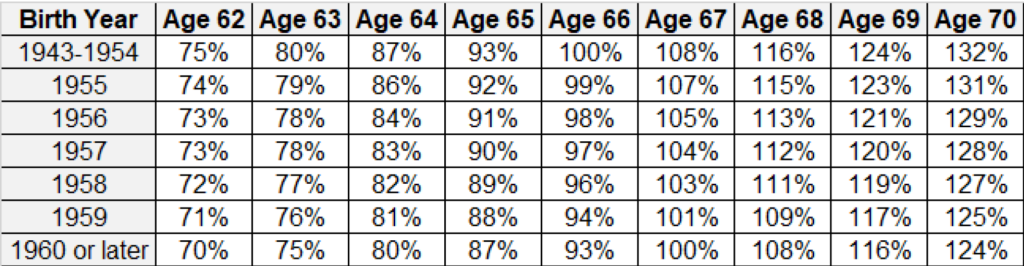

- Full retirement age (based on birth year) – If you were born after 1960 your full retirement age is age 67. If you start your benefits before your full retirement age you can expect that your benefit will be permanently reduced. On the other hand every year you delay benefits after your full retirement age will increase your expected benefit by about 8%. See chart below to determine what % of your Social Security income will be available at different Full retirement age AND your claiming age based on your birth year.

- Claiming age (when you decide to start your benefits)

For example, if you were born in 1962 then your full retirement age would be age 67. If you chose to start your benefits at age 65 then you would receive 87% of your full retirement benefit (at age 67). That is a 13% reduction in benefits for life. The average retired worker in April 2023 brings home about $1,800 each month. A 13% reductions in benefits is $234 less each month or $2,808 less each year. Assuming a typical life expectancy of age 85, it means $2,808 less each year with a 3% inflation adjustment over 20 years of retirement. That means by starting at age 65 reduced your lifetime benefit by over $75,000.

Yes but, by starting at age 65 we have two extra years of Social Security income

This statement is true… BUT the two additional years of income are not only reduced by 13% because you started early, in ADDITION the last two years before retirement are among your peak earning years. You lose out on those years being used to calculate your benefit (higher monthly benefit) and instead use two of your lower earnings years or $0.00 if you did not work for 35 years.

Your Claiming year can sometimes MAKE or BREAK your retirement plan

Have prepared and analyzed literally hundreds of retirement plans your Social Security claiming age in one of the wild cards that can make or break your retirement.

Do you have a retirement plan? If not contact Master’s Financial Group and schedule a phone call to speak with one of of retirement planning specialists. Let us help you prepare a Retirement Readiness plan for you and take the anxiety out of preparing for retirement.

In Part 3 of this Social Security series (last post) we will show you how to get your current expected Social Security benefit, as a spouse how you can collect off of your current (or previous) husbands benefit and how to determine when each spouse should start their benefit.

Dave Conley, CFP