A lot of newsletters, blogs, articles, broadcasts, and podcasts these days will tell you the end is near and that doom is inevitable when it comes to the stock market. But the reality is much less dramatic: over time, markets tend to go up—even when they temporarily go down.

Over the long term, the power of accelerating returns far outweighs the impact of short-term losses. Don’t mishear me—downturns and volatility are inevitable. They’re part of the investing journey. But I would be cautious of outlets that claim to have it all figured out or promise they know exactly what will happen over the next year.

When in doubt – Zoom Out.

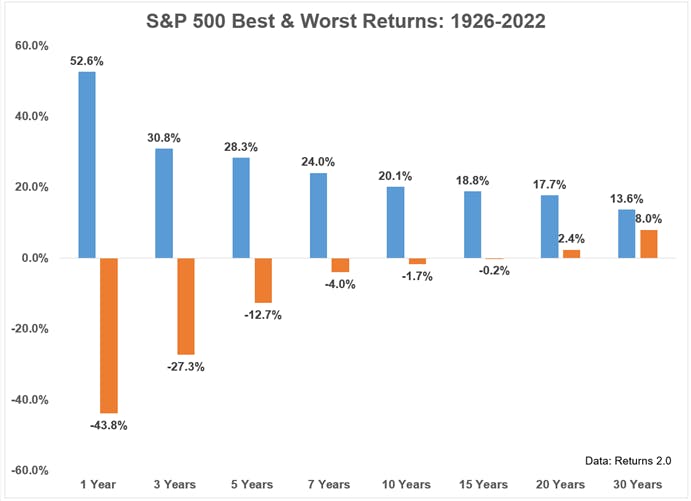

Investing makes the most sense over a longer time horizon. Take the chart below, for example. Depending on an investor’s time horizon, the range of possible investment outcomes narrows the longer money stays invested. In other words, if you park your money, set it, and forget it, the probability of achieving positive returns becomes more certain over time. On the flip side, the shorter your time horizon, the wider—and more unpredictable—the range of outcomes becomes.

Source: Ritholtz Wealth Management

How does having a Financial Advisor help?

Now, it’s important to point out that both the upper and lower ends of that chart depend heavily on how and what you invest in. That’s why working with a financial professional matters — someone who aligns their investment advice with your comfort level, goals, and time horizon. Master’s Financial Group advises our clients to invest in things they understand with the goal of making a positive return when possible, while not losing as much when it’s unavoidable.

When markets feel gloomy, and headlines grow louder, an advisor helps separate noise from reality—keeping your decisions grounded in discipline, diversification, and long-term perspective rather than fear. A good advisor doesn’t promise to predict the future; they help you prepare for it, stay invested through uncertainty, and align your strategy with what truly matters to you. When emotions run high, guidance and perspective can be just as valuable as returns themselves.