Everyone begins their investment journey at different stages in life, however, we can all agree that the sooner you start, the better your portfolio will be in 10, 20, or even 30 years. This equates to a better life in retirement.

But why invest now, when the market is down so much, and there could possibly be a recession soon? The simplest answer is the longstanding “buy low, sell high” adage. If Shane, who recently paid off his student loans, has no other debt besides his mortgage, decides to invest during a bear market (a market experiencing prolonged price declines) and that bear turns to a bull market — which traditionally has taken 289 days, or nine and a half months (Avery, 2022) there would be no complaints from Shane as he watches his portfolio grow with or without contributions.

What happens if Shane invests his money, and that bear market continues its volatile ways and turns into a recession while he keeps investing? When should he buy, how will he know when is the best time to put money into the market?

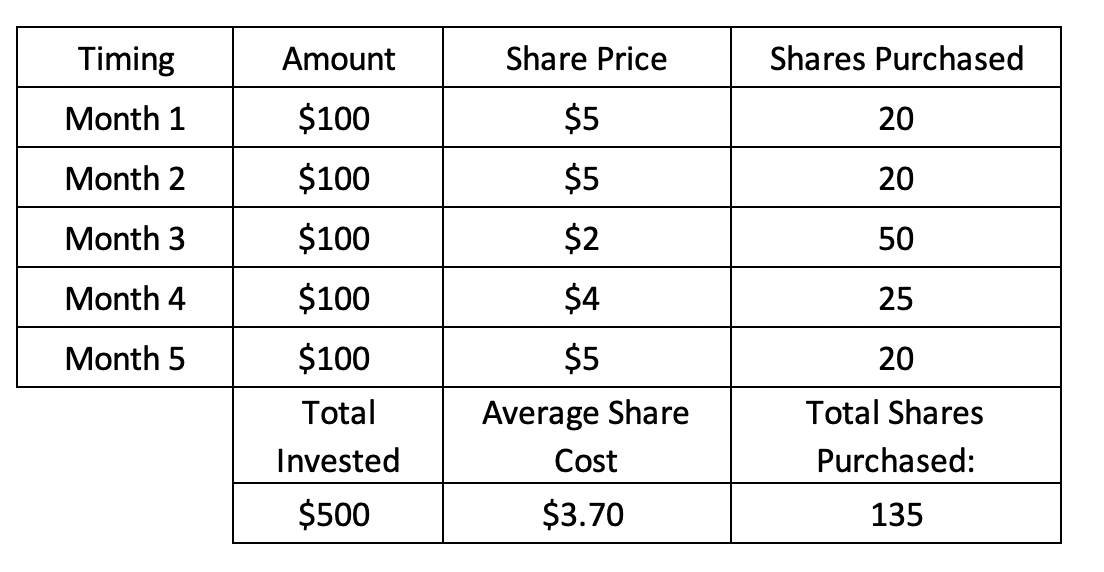

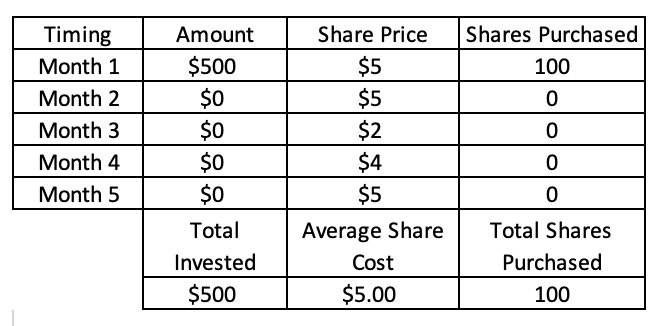

Well, that is where dollar cost averaging comes into play, which is investing a fixed dollar amount on a regular basis (monthly is typical), which benefits the investor in a multitude of ways, including establishing healthy investment habits, minimizing market regrets, minimizing the effects of market volatility, and reducing missed opportunities (Hayes, 2022). The two charts below show how investing the same amount of money monthly increases share totals due to the fluctuating prices of the market, increasing Shane’s holdings by 35%.

$500 invested utilizing the dollar cost averaging system

$500 invested not utilizing the dollar cost averaging system

So what is the difference? Utilizing the dollar cost averaging system Shane was able to obtain 35% more shares, meaning a larger portfolio value as the share prices increase.

No one knows when the optimal time to invest is (unless you are looking at the market historically), but the United States Stock Market has always rebounded (after all, the stock market is merely a reflection of businesses / companies), and the current market should be no different from the past unless it does something it has never done before.

References

- Avery, D. (2022, June 25). Bear market: How long will stocks fall and could it cause a recession? https://www.cnet.com/personal-finance/bear-market-how-long-will-stocks-fall-and-could-it-cause-a-recession/#:~:text=How%20long%20does%20a%20bear,about%20nine%20and%20half%20months.

- Hayes, A. (2022, May 28). Understanding dollar-cost averaging (DCA). https://www.investopedia.com/terms/d/dollarcostaveraging.asp

- Miller, S. (2022). 2022 Coin and Arrow Picture. SHRM. https://www.shrm.org/resourcesandtools/hr-topics/compensation/pages/inflation-rate-hits-7-percent-year-over-year-driving-real-wages-down.aspx.