Category: Financial Advice

Everyone has met someone who had a friend who “made a fortune on XYZ stock on a hot tip”, but much like expecting to win the lottery, expecting to cash in on a hot tip probably won’t happen for you, me, or even someone you know. Seemingly everything we do in today’s world is at...

As a financial planner, I know that Social Security benefits are (or will be) a critical source of retirement income for many of our clients (and most Americans), particularly those who are 55 or older. According to the Social Security Administration (SSA), in 2021, the average monthly Social Security retirement benefit for a retired worker is $1,557. Over the next 3 weeks I will cover strategies you can take to maximize your potential Social Security benefit.

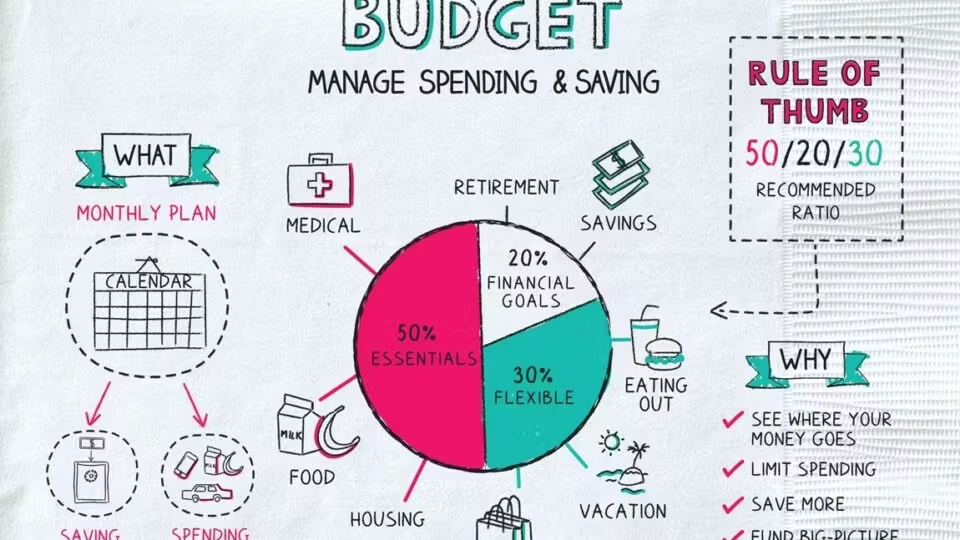

Tracking your money is an important part of managing your personal finances. By keeping track of your income and expenses, you can better understand where your money is going and make informed decisions about how to save and spend. In this blog, we’ll cover some better ways to track your money. Use Budgeting Apps: There...

As a financial planner with 25 years of experience, I understand that investing can be daunting, especially in uncertain times. With recent news of bank financial distress, it's natural for many clients to feel anxious about the safety of their investments. However, I'm here to assure you that the US economy, markets, and financial system are resilient, and there's no need to panic.

A financial advisor is an invaluable asset to managing your finances and providing you with personalized advice specifically for you. When you begin your relationship with your financial advisor you tend to have many face-to-face interactions as the long-term relationship is being established. Once a plan is in place the meetings slow down, but don’t...

“Awareness is like the sun. When it shines on things, they are transformed.” Thich Nhan Hanh Becoming aware of our spending is one of the most powerful tools we have. Why? In examining our spending we become aware of ourselves. Budgeting is simply being aware of our spending. Why is this keeping track of how...

Employer-sponsored retirement plans offering a Roth 401(k) have been slow to adapt to offering the Roth 401(k) alternative to their participants. In 2011 only 49% of plans included a Roth 401(k) option, however, in 2021 that number spiked to 88%. Although subtle, there are some differences between a Roth 401(k) and a Roth IRA we...

Cable and online financial news (for the average investor) can also be overwhelming and cause investors to make mistakes. The term I use for this news is “Financial Pornography”. I can think of many bad decisions made by viewers of financial porn but narrowed it down to four mistakes the average investor is likely to...

As a professional investor for almost 30 years, I rely on my own experiences to help guide my investment approach. Every crisis is different, but they often have things in common. The financial crisis of 2007-2008 was a difficult time for many investors, with stocks and bonds experiencing significant losses. While it’s impossible to predict...

A bucket list are activities we’d like to do before we die. Everyone has a bucket list, even if it isn’t written down. Don’t you catch yourself saying things like “one day I’d like to…” or “before I die, I’m going to…”? How will you fund those adventures if you aren’t planning for them? Frequently...