Author: Dave Conley

I am a Certified Financial Planner™ who has helped our investment clients in their pursuit of financial peace. My 25+ years of financial planning EXPERIENCE has allowed me to help our clients as they pursue financial peace. My definition of financial peace is "having the resources (time, health & money) to do the things you enjoy with the people that you love."

What's you plan for financial peace?

The S&P 500 or the Dow Jones Industrial Average are not reality. Reality is not price-to-earnings ratios and technical market studies. Symbols on the computer screen are not the real world. In the real world, companies create wealth. Stock certificates don’t. Stock certificates are simply proxies for reality.

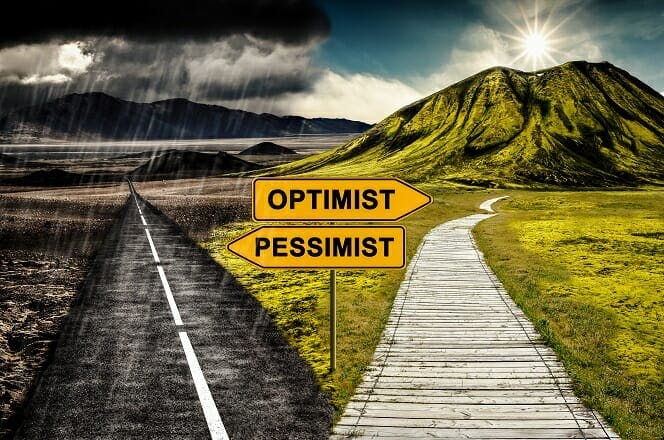

The general economic model of a recession is that when unemployment rises, consumers are more likely to save than spend. This places pressure on businesses that rely on consumers’ income being spent. As a result, company earnings and stock prices decline, which can fuel a negative cycle of economic decline and negative expectations of returns.

It is incredibly difficult for anyone to consistently beat the market and avoid behavioral mistakes. There is no magical set of rules, a formula, or an “Easy Button” that can generate market-beating results. It doesn’t exist and never will. Beware of “gurus” selling a hands-off, rules-based system to investing. If such a system existed, the owner wouldn’t have a need to sell books or subscriptions. Mark Twain said it best when he said "It’s easier to fool people than to convince them that they have been fooled".

How much money is enough? For John D. Rockefeller the answer was “just a little bit more.” At the pinnacle of his success, Rockefeller had a net worth of about 1% of the entire US economy (about 1/3 of a trillion dollars). He owned 90% of all the oil & gas industry of his time....

The hamster wheel literally describes the concept of lots of activity but making no progress. In times of crisis, either real or imagined we are encouraged to do something. If your house is on fire or if you witness a car accident you must do something and quick. Why is it that doing nothing when it comes to our investments is so difficult. When clients ask "what are you doing..." sometimes the better question is "is there anything that needs to be done" related to our investments? Are you OK with doing nothing when nothing needed to be done?

Ralph and Betty recently bought a new Ford Explorer SUV for $40,000, after carefully research before the purchase. Surprisingly, over the next few months they began to receive offers to buy the vehicle from them at smaller and smaller amounts of money. As far as they knew the vehicle was still in great shape, it had a few thousand miles on it, a ding or two but apart from that the engine still purred and ran like it did when they bought it. Still, Ralph and Betty considered selling the Ford Explorer for half of what they paid for it because they worried that something might be wrong. Should they have sold the vehicle?

We so desperately try to nail down certainty in every area of our life but this pesky thing known as reality gets in our way. The realities of life refuse to conform to our desire for certainty. We make plans for our lives and then reality "happens" and throws a monkey wrench into our plans.

Just like we do not know when we are in a recession (until after it has started), the markets begin their recovery in the midst of bad news. It is critical top your wealth to understand this fact: the markets (stocks & bonds) typically reflect where the economy is headed in 3-6 months from today. If you wait for the news to tell you the markets have recovered, the economy has turned around you probably missed out on a good portion of the initial recovery.

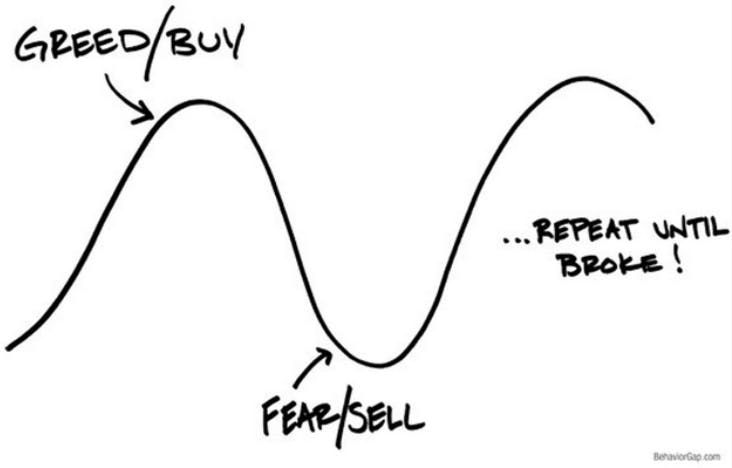

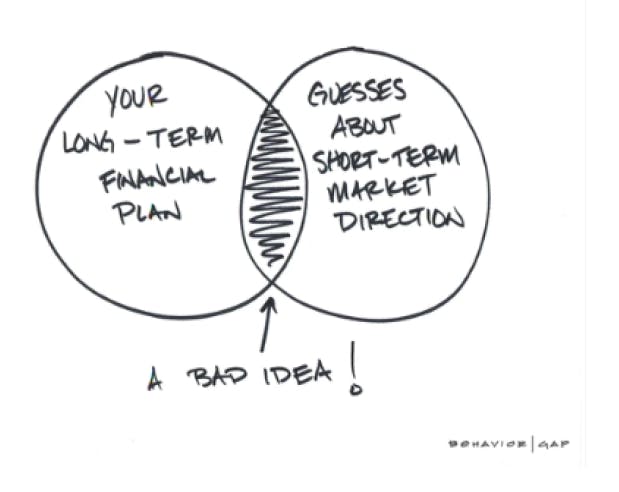

Most of us make the same mistake with our money over and over: We buy high (when the economy and markets are up) out of greed and sell low (when the economy and markets are down) out of fear, despite knowing on an intellectual level that it is a very bad idea.

Each and every month we get a question that is similar to the statement above. The questions are sincere but based on the assumption that one can invest in the markets painlessly. What I mean by that is I can get marketlike returns when the market is going up, then jump out of the market...