I had a meeting with an individual today, and they brought up a great point I’d like to share.

Before retiring, he was a teacher and would talk to his students about being fiscally responsible. He would explain to them that the first purchase a college graduate makes is normally a car.

Now buying a car in and of itself is not a bad practice, however, not properly budgeting can really hinder what could be your first years of investing.

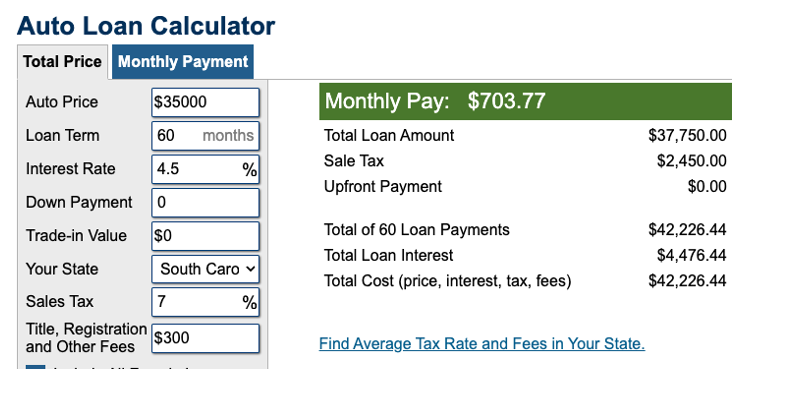

One can assume most college graduates want to treat themselves for their hard work, and what better way to do so than purchase a brand-new car? Given the fact that the average new car payment in America is $700 a month (see my previous blog post on the topic here), I’ll use that figure for this assessment.

You see above that that recent grad would pay off their new car in five years, paying a total of $42,226.44 for a $35,000 loan.

What if they purchased a much more affordable car, and their monthly payment was only $200?

They could then invest $500 a month; what would $500 a month invested for the life of that car loan equate to versus just paying off a brand-new car?

That same grad would have $33,090 invested for their future (with a conservative estimated return on investment of 4%).

So it comes down to perspective, would you rather pay off a car at $700 a month for five years, or buy a reasonably priced vehicle while being able to invest for your future?

Schedule a meeting with MFG today via our scheduling link!