Like Dave Ramsey says, a lot of people state they will always have a car payment, which is something I personally have said most of my adult life. This is because we’ve learned to budget our lives around paying our necessities like the mortgage, groceries, water, electricity, and…car payments?

According to 2022 data from Experian, the average car payment in America is:

For a new vehicle: $700

For a used vehicle: $525

For a leased vehicle: $567

We all love that new car smell, and enjoy showing off our newly purchased car, but is it worth it?

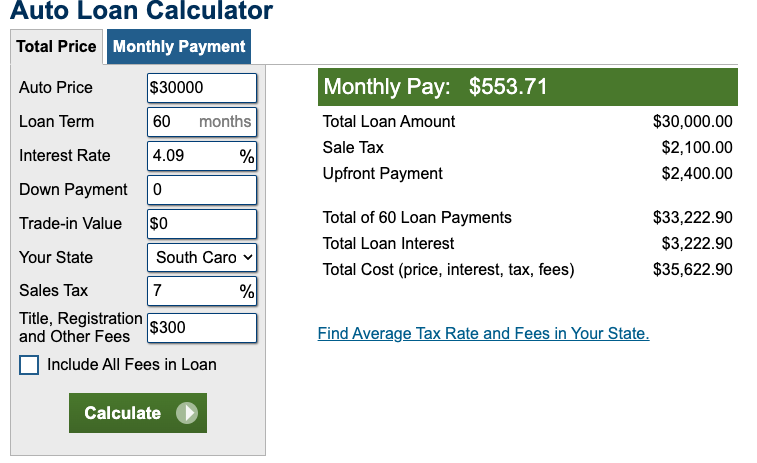

If you purchase a car for $30,000 at 4.09% you’ll be paying $554 a month for the next 60 months.

After your final car payment, you have paid $33,222:

Can you get by with a “clunker” until you save enough for a new car to pay cash? Of course.

It will take a mindset change, but imagine if you save that $554 you’re paying a month for a car payment instead of paying the bank plus an average interest rate of 4-9%.

In one year, you would have saved $6,648.

In five years, you would have saved $33,240.

According to separate research by Experian, 61% of “wealthy” people drive Hondas, Toyotas, or Fords. They define the wealthy as those earning $250,000+ a year.

Can households who earn over $250,000 a year afford a top-of-the-line Mercedes, BMW, Lexus, or another luxury car? Yes, but the majority choose not to.

I am not suggesting that you should not finance your next vehicle, however, I hope you take some of these tips into consideration!

As always, reach out by clicking here if you have any questions or would like to schedule your annual review.