I “herd” it through the grapevine…

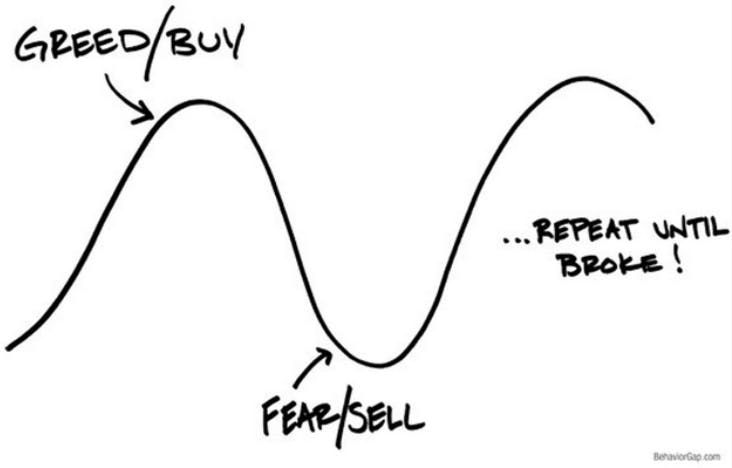

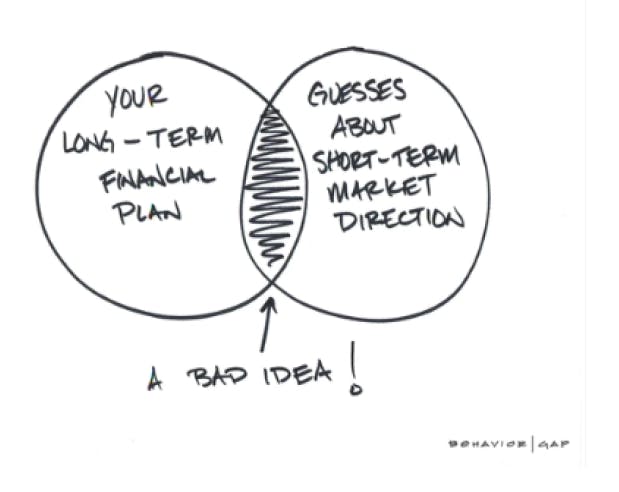

Ralph and Betty recently bought a new Ford Explorer SUV for $40,000, after carefully research before the purchase. Surprisingly, over the next few months they began to receive offers to buy the vehicle from them at smaller and smaller amounts of money. As far as they knew the vehicle was still in great shape, it had a few thousand miles on it, a ding or two but apart from that the engine still purred and ran like it did when they bought it. Still, Ralph and Betty considered selling the Ford Explorer for half of what they paid for it because they worried that something might be wrong. Should they have sold the vehicle?