We’ve blogged about responsible credit card usage, calculations used to determine minimum payments, and other points on credit cards. This week we’ll discuss some common “tips” you may receive from friends and family about credit cards.

Myth #1 Paying the minimum balance is ok

Sure, paying the minimum due is acceptable and it’s actually welcomed by the credit card company, but why would this be the right decision for you and your finances?

You can click here to see my previous example of paying the minimum balance, then I want you to check out the following example.

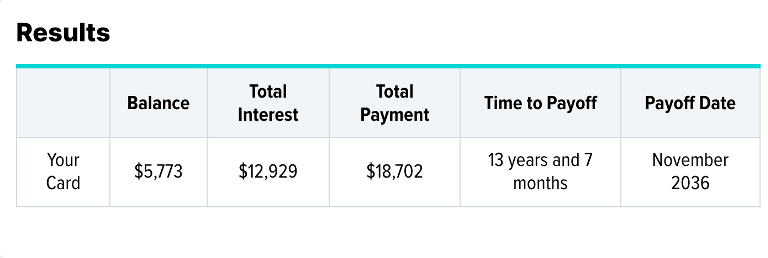

I used a conservative number for a credit card balance in my prior post, for this example, we’ll use the national average, which according to CNBC, is $5,733. We’ll also use the national average interest rate on credit cards, which wallethub.com recently shared is 22.58% for new customers.

We will divide the annual interest rate by 12 to determine the monthly interest charge on the account.

- 22.58%/12=1.882%/month

- 1.882% x $5,773 = $108.65

Your minimum payment is typically between 1-3% of the balance (we will use 2% again).

- 2% of $5,773=$115.46

- Let’s look closer at this:

- Minimum payment: $115.46

- Interest charged: $108.65

- Balance decreased by: $6.81

- Percentage of your minimum payment that went toward principal: 5.898%

How long would it take you to pay off this credit card assuming no change in interest rate and no further purchases were made?

I don’t know about you, but I would feel awful if I were to tell someone they are “ok” to just pay their minimum balance, knowing they’d almost triple the original loan amount!

Myth #2 Closing a credit card helps your credit score

This bit of advice seems like it could be true, right? Close an account you don’t use anymore to show you don’t “need” it, and to avoid accidental usage. All that really happens when you close a fee-free credit card is your credit card usage percentage increases, thus lowering your credit score.

Myth #3 Carrying a balance on your credit card helps your credit score

Another concept that came out at some point, however, all carrying a balance does is cause you to pay interest on the balance. The best way to utilize a credit card is to pay it off each month.

Myth #4 Using a credit card will hurt your credit score

This CAN be true, if you are irresponsible. If you are paying your card off each month, then you are building on your credit history, which increases your score.

Do you know what impacts your credit score the most? Your payment history! This accounts for 35% of your credit score, followed closely by the total amount you owe, which is 30% of your credit score.

We no longer live in a time that we have to take what a friend or relative tells us as fact, if you don’t know how something works, especially when it pertains to your finances, conduct a quick online search. If you don’t find what you’re looking for there, give us a call or schedule a meeting so we can keep you informed!