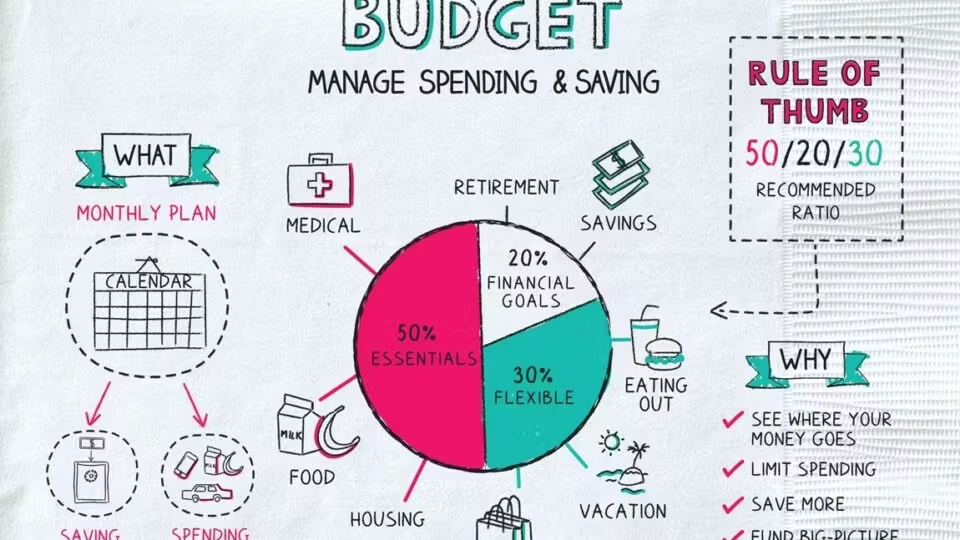

Budgeting equals $$ Awareness

“Awareness is like the sun. When it shines on things, they are transformed.” Thich Nhan Hanh Becoming aware of our spending is one of the most powerful tools we have. Why? In examining our spending we become aware of ourselves. Budgeting is simply being aware of our spending. Why is this keeping track of how...