Category: Financial Advice

Have you been fearing that you will be living in poverty in your golden years because news articles and studies have long stated that Americans do not know how to save or don’t save enough? In 2002 the Economic Policy Institute study reported that 40% of households then aged 47-64 would retire on less than...

We so desperately try to nail down certainty in every area of our life but this pesky thing known as reality gets in our way. The realities of life refuse to conform to our desire for certainty. We make plans for our lives and then reality "happens" and throws a monkey wrench into our plans.

It is finally cooling down, and with the cooler temperatures comes the desire for a nice, hot, beverage. The easiest way to acquire these seemingly magical drinks is to run by the drive-through of your favorite coffee shop. Did you know the average cup of coffee has risen to $4.90?! You don’t have to stop...

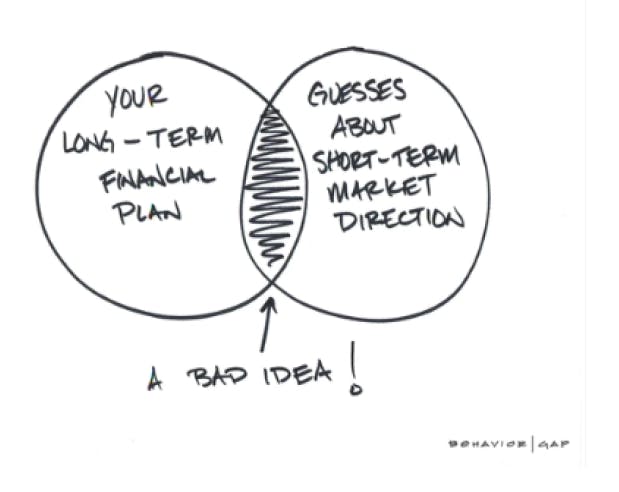

Just like we do not know when we are in a recession (until after it has started), the markets begin their recovery in the midst of bad news. It is critical top your wealth to understand this fact: the markets (stocks & bonds) typically reflect where the economy is headed in 3-6 months from today. If you wait for the news to tell you the markets have recovered, the economy has turned around you probably missed out on a good portion of the initial recovery.

Have you ever heard someone say something to the effect of “a dream is only a dream until you write it down, then it becomes a goal”? This concept examines how we view seemingly impossible things, like getting our “dream” job, living in the “dream” town, climbing Mount Everest, or completing a marathon. You wouldn’t...

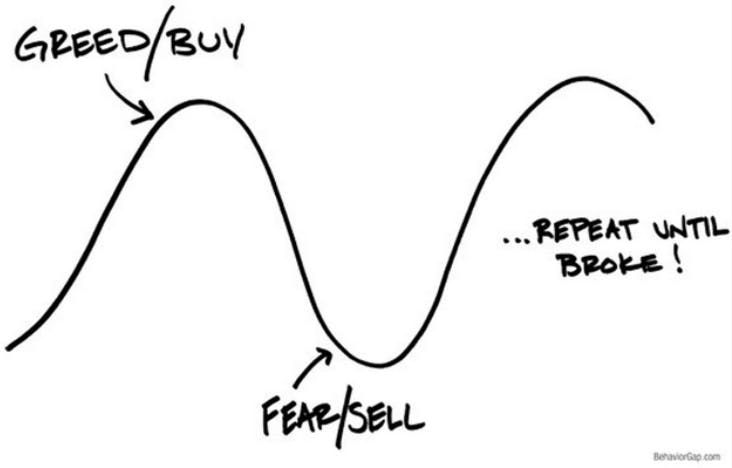

Most of us make the same mistake with our money over and over: We buy high (when the economy and markets are up) out of greed and sell low (when the economy and markets are down) out of fear, despite knowing on an intellectual level that it is a very bad idea.

Each and every month we get a question that is similar to the statement above. The questions are sincere but based on the assumption that one can invest in the markets painlessly. What I mean by that is I can get marketlike returns when the market is going up, then jump out of the market...

These days, rising food prices have us all wondering how to make ends meet. Even if you have lots of money at the end of your month, you are still probably looking for ways to stretch your dollars?! Right? I believe the absolute best way to stretch that food budget and get the most bang...

South Carolina taxpayers can deduct 100% of their contributions on their state tax returns (one of only four states that offer 100% of contributions to be claimed). There are two types of 529 plans: prepaid tuition plans and education savings plans. Prepaid Tuition Plans allow the account holder to purchase credits for future use at...

Are you sinking your funds? We talk about budgets a lot around here. We believe that having a budget for your monthly expenses is terrific! But, don’t forget you have some expenses that are not monthly and some that are definitely not regular. Some bills will only come to your mailbox once a year. Bills...