Category: Financial Peace

As a financial planner with 25 years of experience, I understand that investing can be daunting, especially in uncertain times. With recent news of bank financial distress, it's natural for many clients to feel anxious about the safety of their investments. However, I'm here to assure you that the US economy, markets, and financial system are resilient, and there's no need to panic.

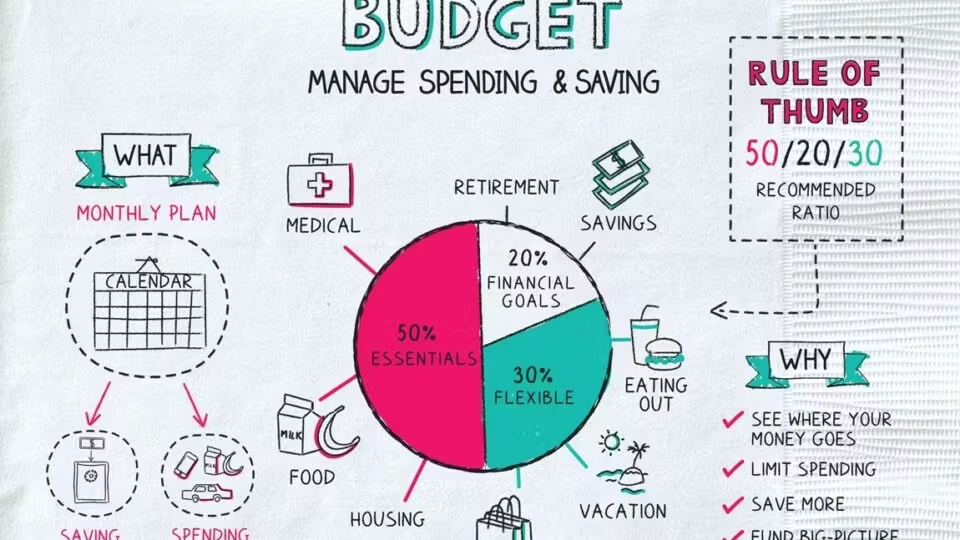

“Awareness is like the sun. When it shines on things, they are transformed.” Thich Nhan Hanh Becoming aware of our spending is one of the most powerful tools we have. Why? In examining our spending we become aware of ourselves. Budgeting is simply being aware of our spending. Why is this keeping track of how...

Cable and online financial news (for the average investor) can also be overwhelming and cause investors to make mistakes. The term I use for this news is “Financial Pornography”. I can think of many bad decisions made by viewers of financial porn but narrowed it down to four mistakes the average investor is likely to...

As a professional investor for almost 30 years, I rely on my own experiences to help guide my investment approach. Every crisis is different, but they often have things in common. The financial crisis of 2007-2008 was a difficult time for many investors, with stocks and bonds experiencing significant losses. While it’s impossible to predict...

A bucket list are activities we’d like to do before we die. Everyone has a bucket list, even if it isn’t written down. Don’t you catch yourself saying things like “one day I’d like to…” or “before I die, I’m going to…”? How will you fund those adventures if you aren’t planning for them? Frequently...

If you are like….everyone else in the world, saving is not at the top of your “fun things to do” list, nor is it an easy task. So, here are some ways that you can ensure you pay yourself with a little less stress about the topic. Pay Yourself First You’ve probably heard the phrase...

Investing can often feel like a daunting task, especially for those just starting out. But with the right approach, it can be a rewarding and fulfilling journey. One way to think about investing is to see it as following a treasure map. With every step along the way, you'll encounter challenges and obstacles, but if you keep your eye on the prize, you'll eventually reach the reward at the end.

Retirement is a time when many investors shift their focus from accumulating wealth to preserving and generating income from their existing assets. As an investor nearing retirement, there are several key considerations to keep in mind to ensure a successful transition into retirement. Here are the five most important things an investor within five years...

Just for a minute, imagine what it might feel like to be satisfied with simply having “Enough.” How might that change your priorities? Your daily schedule? It’s important you actually sit down and think about it because only you can define “Enough.”

What might happen if you were to make this shift? Would you work less? Would you spend less? Would you sleep more? Would you quit your job and start something new? Would you give more to charity?

Maybe nothing new would happen. But what I can tell you is this: If you can’t find a way to be satisfied with enough, you may never be satisfied with anything.

Predicting the direction of the market is like predicting when you will hit the bulls-eye in a dart game. The majority of the time throughout market history, the markets have been rising. History shows that the chance of your money growing in a diversified portfolio of stocks and bonds is much like the odds of your next dart hitting any number on the dartboard... except the bulls-eye. If you are going to try and time the market by moving your money in and out, you have to ask yourself how confident are you that you can hit the bullseye when you do.