Author: Dave Conley

I am a Certified Financial Planner™ who has helped our investment clients in their pursuit of financial peace. My 25+ years of financial planning EXPERIENCE has allowed me to help our clients as they pursue financial peace. My definition of financial peace is "having the resources (time, health & money) to do the things you enjoy with the people that you love."

What's you plan for financial peace?

As a financial planner, I know that Social Security benefits are (or will be) a critical source of retirement income for many of our clients (and most Americans), particularly those who are 55 or older. According to the Social Security Administration (SSA), in 2021, the average monthly Social Security retirement benefit for a retired worker is $1,557. Over the next 3 weeks I will cover strategies you can take to maximize your potential Social Security benefit.

As a financial planner with 25 years of experience, I understand that investing can be daunting, especially in uncertain times. With recent news of bank financial distress, it's natural for many clients to feel anxious about the safety of their investments. However, I'm here to assure you that the US economy, markets, and financial system are resilient, and there's no need to panic.

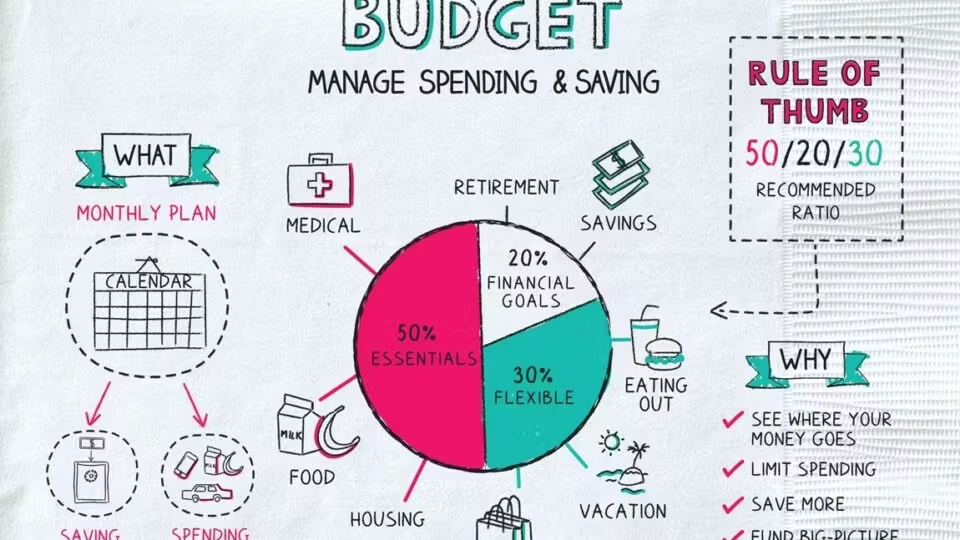

“Awareness is like the sun. When it shines on things, they are transformed.” Thich Nhan Hanh Becoming aware of our spending is one of the most powerful tools we have. Why? In examining our spending we become aware of ourselves. Budgeting is simply being aware of our spending. Why is this keeping track of how...

Cable and online financial news (for the average investor) can also be overwhelming and cause investors to make mistakes. The term I use for this news is “Financial Pornography”. I can think of many bad decisions made by viewers of financial porn but narrowed it down to four mistakes the average investor is likely to...

As a professional investor for almost 30 years, I rely on my own experiences to help guide my investment approach. Every crisis is different, but they often have things in common. The financial crisis of 2007-2008 was a difficult time for many investors, with stocks and bonds experiencing significant losses. While it’s impossible to predict...

How widespread is the current banking turmoil? Should we be concerned about our bank deposits? Are the current challenges unique or similar to other banking turmoil in the past? Are there investment opportunities in this economic environment?

Although there is no foolproof formula for investing success or failure there are traits that those who do well over the long term possess.

As a financial planner with 25 years of experience, I have seen many investors succeed and others struggle. Through my experience, I have identified three primary characteristics or habits of a good investor and three characteristics or habits of poor investors.

Retirement is a stage of life that everyone looks forward to, after years of hard work and saving. However, the key to a happy retirement is having enough money to sustain you during this phase of your life. One of the most important decisions you will make during your retirement is how much of your savings you can safely spend each year. In this blog post, we will outline the top 5 retirement spending strategies that retirees can use to plan their retirement spending.

I ask potential clients to describe their version of financial freedom (or financial peace) and how we can help them achieve this goal. It’s extremely common for the answers to center on some sort of financial/investment success metric. Stuff like:• Increase my investment returns to 10% a year consistently with minimal risk.• Pay off all...

Why do the typical investors investment returns trail the investment returns of the investments (mutual funds, ETF's, etc.) they are investing?