Category: Financial Peace

Comparing finances to others can distract families from their true goals. Values-based financial planning helps create clarity, confidence, and long-term financial peace.

When markets feel gloomy, and headlines grow louder, an advisor helps separate noise from reality

One of the biggest questions families ask is simple but important: What’s the best way to pass assets to loved ones after we’re gone? Two common tools are Transfer-on-Death (TOD) designations and trusts. Both can work well—but they do very different jobs. Transfer-on-Death (TOD): Simple and Direct A Transfer-on-Death designation lets you name who receives...

Financial markets, news, social media, and even the church potluck are saturated with commentary. Intelligence and information are common; discipline is scarce.

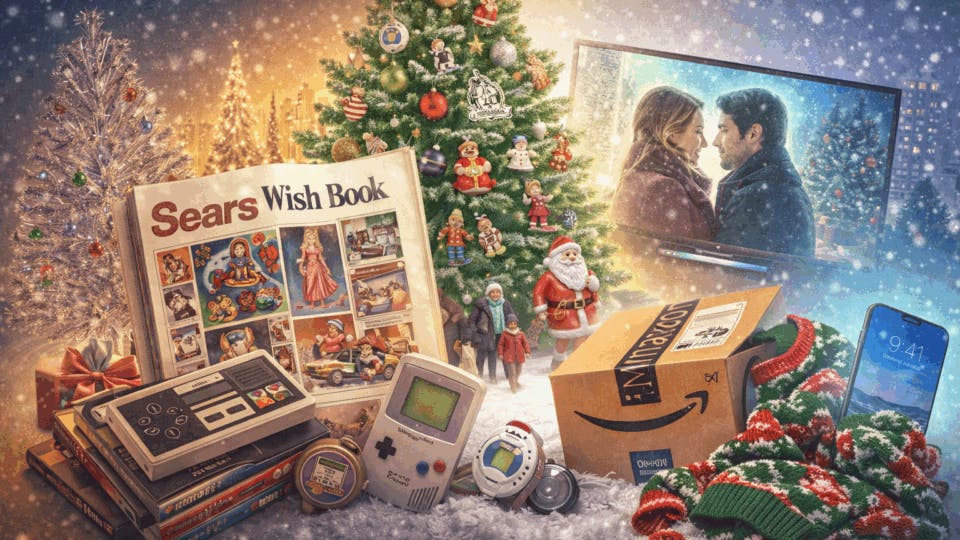

In my 50 years of life, the Christmas season has changed — not only for me personally, but in society as a whole. What was once a tradition-focused, family- and community-oriented season has slowly shifted into something more secular and convenience-driven. Here are my memories of Christmas over the past five decades — the trends,...

You’ve probably been on a road trip with a gaggle of kids before and heard the question, “Are we there yet?” Whether they were your own children, nieces and nephews, or maybe it was you asking when you were a kid, it’s a familiar concept. When you’re on a road trip, the question banging around...

If you’re getting close to retirement—or just recently entered it—here’s a simple question: Do you have a written financial plan for your retirement? Transamerica did a survey of baby boomers and found that their top two retirement fears are both financial. The good news? Those fears can often be addressed with a clear, written retirement...

When it comes to investing, stories can be powerful. A good story can make people excited, confident, or even a little fearful — and those emotions can move the market just as much as company performance does. When that happens, people start buying or selling based on headlines and hype rather than what a company is actually worth.

Baseball Hall of Famer Yogi Berra once said, “Baseball is 90% mental; the other half is physical.” The same can be said about money and investing — 90% of it is behavior, and the other “half” is knowledge.

This past Sunday, October 12th, marked the third anniversary of the current bull market. Since its start in 2022, the market has surged 89%, well above historical averages. It’s the 27th bull market since 1872 and the 14th since 1950, and while past performance doesn’t guarantee future results, history suggests markets with this kind of...